Feeling the pinch of rising prices? Inflation is creeping through the US economy, eroding the value of your hard-earned dollars. But one asset is capturing the attention of savvy investors and financial experts alike—Bitcoin! This decentralized digital currency isn’t just a fad; it’s a lifeboat in an ocean of rising costs and economic uncertainty.

This blog will show how Bitcoin can protect your wealth during inflation and why it’s time to consider seriously adding it to your portfolio. We’ll cover key reasons like its deflationary nature, independence from central banks, and unique characteristics as “digital gold.” Buckle up—you’ll discover how to outsmart inflation like a pro!

What is Driving Inflation in the US?

Before we jump into Bitcoin’s role, let’s take a quick look at what’s fueling inflation in the US.

Price Pressures

The US economy has experienced significant price increases on everything from groceries to housing. According to the CPI (Consumer Price Index), inflation hit over 9% in mid-2022, a level not seen in four decades.

Government Spending & Money Supply

Massive government spending and Federal Reserve policies like quantitative easing (QE) have injected trillions into the economy. The result? The money supply has grown, but its purchasing power has dropped—an economic recipe for inflation.

Supply Chain Disruptions

Global supply chain bottlenecks from events like the pandemic and geopolitical unrest (facial recognition, anyone?) have also contributed to costs.

And with inflation rising, idle cash in a savings account loses purchasing power daily. The most intelligent investors are looking for inflation-proof assets.

Enter Bitcoin—the ultimate hedge against inflation.

Why Bitcoin? Deflationary by Design

First things first, what makes Bitcoin unique is its deflationary design. Unlike fiat currencies like the US dollar, Bitcoin has a fixed supply of 21 million coins. That means no institution, government, or central bank can “mint” more Bitcoin, making it virtually immune to inflation caused by money printing.

Think about it. With fiat currencies, central banks can turn on the money printer at will, diluting the value of your cash savings. Bitcoin? Its scarcity ensures that its value can’t be undermined similarly. It’s like owning gold—only digital and much easier to transfer and store.

The Bitcoin Halving

The halving mechanism, which reduces the reward Bitcoin miners receive for adding new blocks to the blockchain by 50% every four years, adds to Bitcoin’s deflationary nature. This built-in scarcity makes Bitcoin even more valuable over time.

Translation? While dollars may buy you less over the years, a Bitcoin could grow in value, making it the ideal hedge against inflation.

Uncorrelated Asset: Bitcoin vs. the US Dollar

The beauty of Bitcoin lies in its independence. Unlike fiat currencies tied to central bank policies, Bitcoin operates on a decentralized network powered by blockchain technology.

Independence from Central Banks

Bitcoin’s price isn’t influenced by interest rate hikes or the Fed’s monetary policy decisions. It’s free from interference, giving investors greater control over their wealth.

The Case for Diversification

Many financial analysts recommend investing at least 3-5% of your portfolio in Bitcoin or crypto assets, especially during inflationary trends. Bitcoin often behaves as an uncorrelated asset, meaning its performance doesn’t move in tandem with traditional investments like stocks or bonds.

This makes Bitcoin not just an investment—it’s insurance against the dollar’s declining value.

Digital Gold With A Modern Twist

Bitcoin is often referred to as “digital gold,” and for good reason. While both Bitcoin and gold share several key traits, Bitcoin edges out its physical counterpart in some critical ways.

- Scarcity: Like gold, Bitcoin’s supply is finite, but its limits (21 million coins) are programmed into its code.

- Portability: Bitcoin can move across borders in seconds, unlike heavy gold bullion. Whether you’re in New York or Tokyo, transferring Bitcoin is easy and seamless.

- Storage: Forget expensive vaults—store Bitcoin securely in a digital wallet.

With inflation heating up, some investors even choose Bitcoin over gold as their inflation hedge.

Real-Life Examples of Bitcoin as an Inflation Hedge

Still skeptical? Just look at countries where inflation has spiraled out of control. Bitcoin served as a financial lifeline for citizens in Venezuela and Argentina, countries with hyperinflation that left their fiat currencies worthless.

Even in the US, big players like Tesla and MicroStrategy are holding Bitcoin as an inflation-resilient asset as inflation climbs. When billion-dollar corporations are betting on digital assets, you know something big is happening.

How to Protect Your Wealth with Bitcoin!

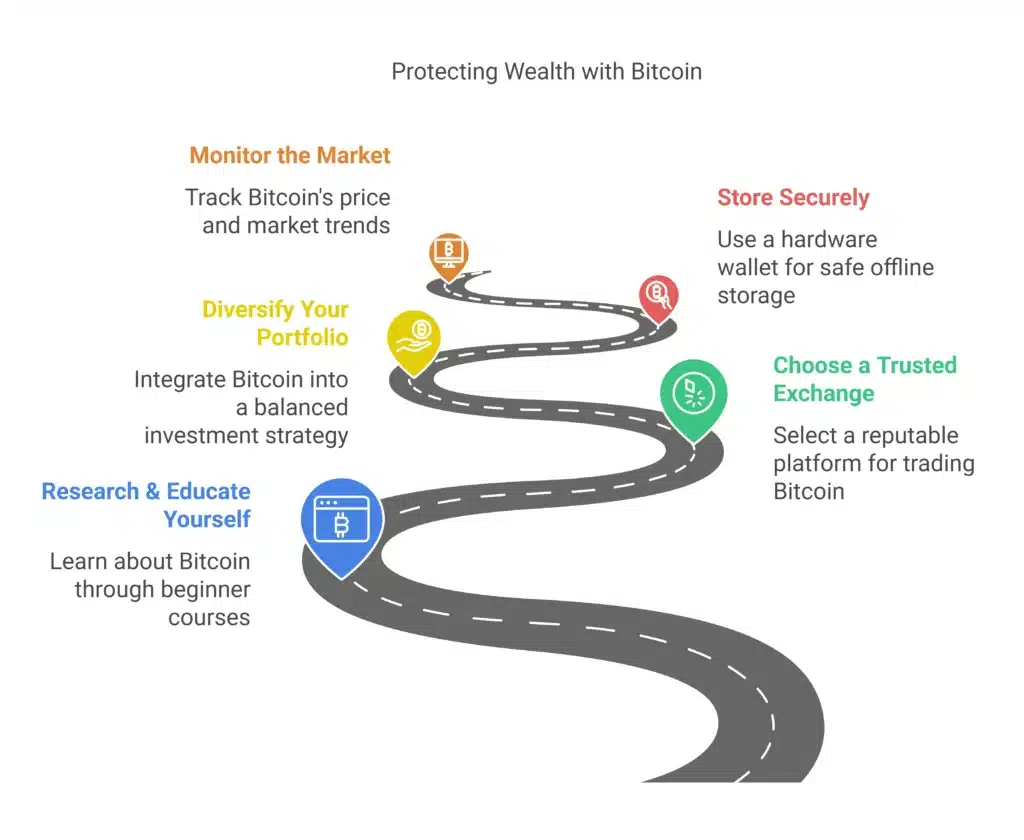

If you’re ready to take action, here’s how to start using Bitcoin to protect yourself from inflation today.

Research & Educate Yourself

Get familiar with Bitcoin and cryptocurrency. Platforms like Coinbase, Binance, and Kraken offer beginner courses to help you get started.

Choose a Trusted Exchange

Find a reputable exchange where you can securely buy and trade Bitcoin. Pay attention to fees, security protocols, and user reviews.

Diversify Your Portfolio

While Bitcoin is an excellent hedge, don’t put all your eggs in one basket. Use Bitcoin as part of a well-thought-out investment strategy.

Store Securely

Invest in a hardware wallet like Ledger or Trezor to store your Bitcoin offline, safe from hackers.

Monitor the Market

Bitcoin’s price is volatile, so keeping track of market trends ensures you enter and exit at the correct times. Pro tip? Set up Google Alerts for Bitcoin news.

The Window of Opportunity is NOW!

Inflation isn’t slowing down, nor is Bitcoin’s rise as a trusted financial asset. The longer you wait to adapt, the more purchasing power you risk losing to inflation.

Whether you’re an investor looking to hedge against rising costs or a financial analyst exploring modern investment solutions, Bitcoin offers a revolutionary way to safeguard your wealth.

Are you ready to harness the power of digital gold? Don’t wait—start protecting your wealth with Bitcoin today!