The year 2024 will be unlike any other year for investing —a time to think and act differently when it comes to investments, whether traditional fare or newer options like Bitcoin. So for US investors the financial outlook is changing quickly, and deciding on the best way to invest could have a big effect on long term financial success.

Curious whether Bitcoin could be your magic wand or whether traditional assets continue to hold the crown? This blog is here to explain the difference and weigh the pros and cons for both, so you can figure out which one suits your financial goals for 2024.

What Are Bitcoin Investments?

Before making comparisons, let’s define Bitcoin investments. Bitcoin is a cryptocurrency—a digital currency powered by blockchain technology. Unlike stocks or bonds, Bitcoin is decentralized, meaning any government or financial institution does not control it. People can buy, trade, and store Bitcoin as a speculative investment or use it for peer-to-peer transactions.

Bitcoin gained notoriety over the past decade for its rapid price increases (and declines), attracting investors looking for high potential returns. But how does it compare with more traditional investment options?

Understanding Traditional Investments

Traditional investments include financial products like stocks, bonds, mutual funds, and real estate. These options have been the backbone of wealth-building strategies for decades. Here’s a quick breakdown:

- Stocks: Shares in a company that provide ownership stakes and the potential to earn money through dividends or price appreciation.

- Bonds: Debt instruments where investors lend money to governments or corporations in exchange for regular interest payments.

- Mutual Funds: Pooled investments managed by professionals that give investors access to diversified portfolios.

- Real Estate: Physical property investments that can generate rental income or appreciate over time.

Traditional investments have long been considered reliable and relatively stable—but are they still the best choice in 2024?

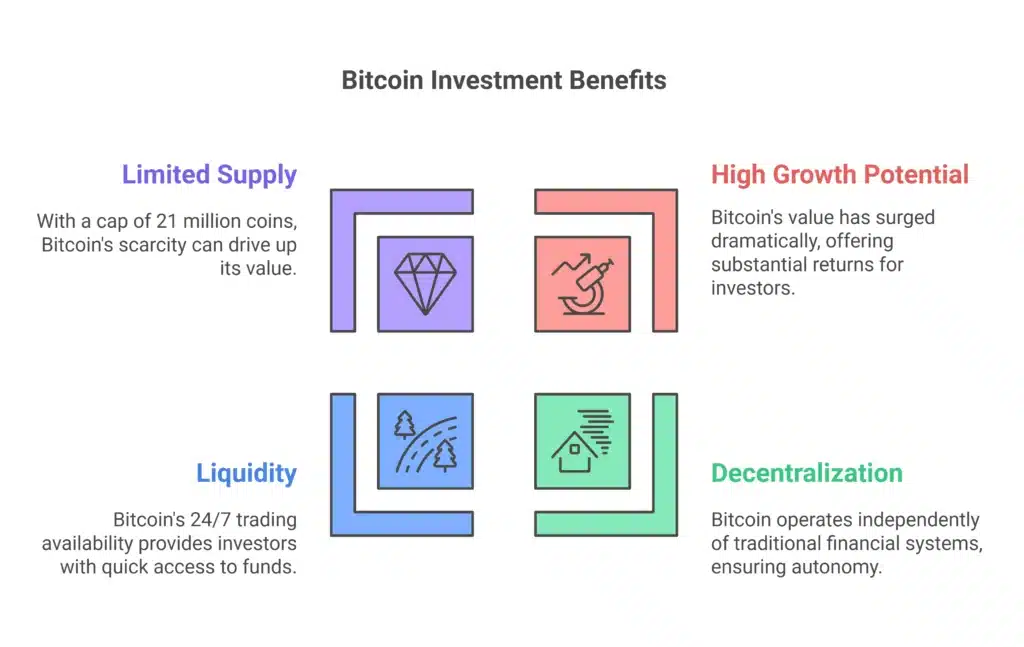

Benefits of Bitcoin Investments

Bitcoin offers several advantages, especially for diversifying their portfolios or seizing opportunities in fast-changing markets. Here are the key benefits:

High Growth Potential

Values of Bitcoin have risen significantly in times of market excitement or adoption. The best example is Bitcoin which went from hundreds of dollars per coin a decade ago to more than $60,000 peak in 2021. Although indisputably volatile, the growth potential is certainly still a tantalizing proposition for high-risk, high-reward investors.

Example: If you had invested $1,000 in Bitcoin in 2013, your investment would have been worth millions by 2021.

Decentralization

Unlike traditional investments, Bitcoin isn’t dependent on banks, governments, or financial systems. This makes Bitcoin an attractive option for those seeking independence from centralized authorities.

Liquidity

Bitcoin can be easily traded on crypto exchanges 24/7. This high liquidity makes it convenient for investors seeking fast access to their funds.

Limited Supply

Bitcoin has a fixed supply of 21 million coins, creating scarcity that can drive up prices over time. Unlike fiat currencies, it cannot be devalued through inflationary measures like printing more money.

Drawbacks of Bitcoin Investments

Bitcoin is not without risks. US investors need to weigh these downsides carefully:

- Volatility: Bitcoin’s price can swing wildly within hours, leading to potentially significant losses.

- Regulatory Risks: Governments may impose regulations or restrictions on cryptocurrencies, impacting their usage and value.

- Lack of Tangibility: Unlike stocks, bonds, or real estate, Bitcoin has no intrinsic value tied to physical assets or company performance.

- Security Concerns: Digital wallets and exchanges are vulnerable to hacks if not carefully secured.

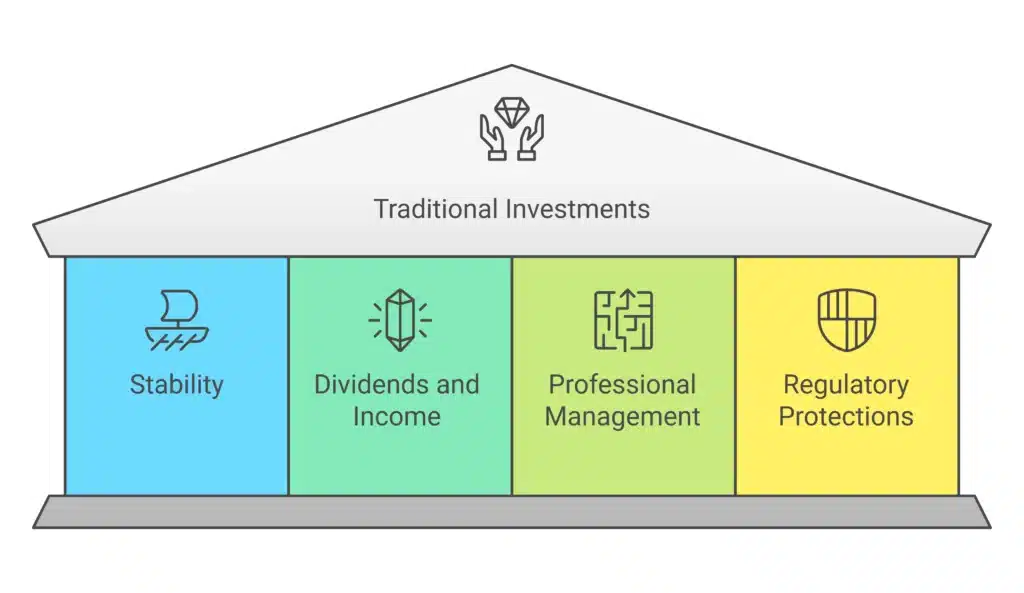

Benefits of Traditional Investments

Traditional investments remain a solid choice for many investors, offering several tried-and-true advantages:

Stability

Traditional investments like bonds and blue-chip stocks are far less volatile than Bitcoin. They offer predictable returns over time, making them ideal for long-term wealth building.

Dividends and Income

Stocks and bonds often provide regular income streams through dividends or interest payments—something Bitcoin lacks.

Professional Management

Traditional investments, such as mutual funds, are professionally managed, helping investors grow their money without the need for constant monitoring or expertise.

Regulatory Protections

Traditional investments are backed by financial regulations that provide a safety net, such as federal insurance for specific accounts and protections against fraud.

Drawbacks of Traditional Investments

While they’re reliable, traditional investments also come with their challenges:

- Lower Growth Potential: Traditional investments rarely deliver the explosive growth seen with Bitcoin (but they also don’t carry the same level of risk).

- Limited Investment Hours: Unlike Bitcoin, traditional stock exchanges operate within set hours, and trades are not instantaneous.

- Inflation Sensitivity: Fixed-income investments like bonds may lose value during periods of high inflation.

Head-to-Head Comparison

| Factor | Bitcoin | Traditional Investments |

|---|---|---|

| Risk | High | Moderate to Low |

| Growth Potential | Very High | Moderate |

| Volatility | High | Low |

| Regulation | Minimal | Strong |

| Liquidity | High (24/7 trading) | Moderate (market hours only) |

| Diversification | Limited | High (many asset classes available) |

Which Should You Choose in 2024?

The choice between Bitcoin and traditional investments ultimately depends on financial goals, risk tolerance, and investing experience.

- Consider Bitcoin if… you’re looking to diversify your portfolio, have a high-risk tolerance, and want potentially explosive growth.

- Stick to Traditional Investments if… you value stability, predictable income, and a more regulated environment for your money.

For many investors, the best opportunities lie in combining these options. Allocating a small percentage of your portfolio to Bitcoin while maintaining a strong foundation of traditional investments can help balance risk and reward.

Tips for Getting Started

Here are a few tips to set yourself up for success, whether you decide to invest in Bitcoin, traditional options, or both:

- Educate Yourself: Take time to understand the risks and benefits of each option.

- Diversify Your Portfolio: Don’t place all your eggs in one basket. The key to successful investing is spreading risk across multiple asset classes.

- Start Small: Especially with Bitcoin, consider starting with a smaller investment until you’re comfortable navigating the crypto market.

- Stay Updated: Markets change quickly, so watch trends and news surrounding cryptocurrency and traditional investments.

Make the Right Choice for Your Portfolio

The financial world in 2024 is as dynamic and exciting as ever. Whether you’re drawn to Bitcoin’s cutting-edge potential or the stability of traditional investments, understanding your options is the first step to building a strong portfolio.

Want to learn more about Bitcoin investment strategies or better understand traditional markets? Stay tuned for more insights and resources to guide your financial decisions.