Bitcoin—one of the most disruptive innovations in recent history—is more than just an investment for tech-savvy enthusiasts. Since its inception in 2009, it has grown from a niche digital currency to a trillion-dollar asset class influencing global markets and economic policy. But what does Bitcoin mean for the US economy? How is it changing the financial landscape, and what does it mean for investors looking to capitalize on this digital revolution?

This blog explores how Bitcoin has impacted the US economy, its role in investment strategies, its influence on traditional financial systems, and where it might be headed.

Introduction to Bitcoin and Its Significance in the Global Economy

Bitcoin is the first and most well-known cryptocurrency—a decentralized digital currency verified by blockchain technology. Unlike traditional money issued by governments and banks, Bitcoin operates on a peer-to-peer system without intermediaries.

Its rise has been meteoric. From being valued at pennies in its early years to hitting an all-time high of $69,000 in 2021, Bitcoin now holds a substantial share of the global financial conversation. It’s seen as a hedge against inflation, a store of value, and even “digital gold.”

For the US, Bitcoin represents a wave of innovation reshaping how value is stored, transferred, and grown. But what does this mean practically for the economy and financial ecosystem?

The Historical and Current Impact of Bitcoin on the US Economy

Bitcoin’s impact on the US economy is multifaceted, influencing industries, policymakers, and everyday citizens.

Economic Opportunities

Bitcoin has created significant economic opportunities by fueling industries around cryptocurrencies. The cryptocurrency market has become a vital economic driver, from exchanges like Coinbase employing thousands to Bitcoin mining operations spurring investments in infrastructure and technology.

Wealth Creation for Investors

For early adopters, Bitcoin has been a game-changer. Many saw massive returns, creating a new wave of wealth, affecting spending habits and, indirectly, consumer behaviour. With more people adopting Bitcoin, wealth circulation and its impact on GDP have become topics of serious study.

Financial Inclusion

A significant proportion of the US population remains unbanked or underbanked. Bitcoin offers an unprecedented opportunity for financial inclusion, allowing anyone with internet access to participate in a global digital economy.

The Role of Bitcoin in Investment Portfolios and Diversification

Is Bitcoin worth adding to your investment portfolio? The answer, increasingly, is yes—for many investors.

Bitcoin has proven to be more than just a speculative asset. It offers diversification benefits because its value isn’t directly tied to traditional markets like stocks or bonds.

Hedge Against Inflation

Bitcoin has a fixed supply of 21 million coins, making it immune (inherently) of inflation unlike the US dollar or other fiat currencies. Investors have begun to consider Bitcoin a hedge against inflation as central banks expand monetary policies.

Volatility Risks

Despite the volatility, Bitcoin’s long-term immunity has caught the interest of the institutional investors. Today, a small allocation (1–5%) to crypto-assets such as Bitcoin has become a part of the portfolio recommended by a number of hedge funds, traditional financial planners, and Robo-Advisors.

Regulatory and Legislative Developments Affecting Bitcoin in the US

The regulatory environment in the US plays a significant role in Bitcoin’s adoption and integration into the economy. Over the years, Bitcoin has moved from the fringes to the mainstream—but not without scrutiny.

Government Oversight

Federal agencies like the SEC and CFTC regulate cryptocurrencies. Their decisions on whether Bitcoin is classified as a commodity, security, or currency shape its market behaviour and legal use.

Tax Implications

Bitcoin is treated as property by the IRS. Tax Implication Using BTC for TransactionCrypto gains tax must be considered by individuals and businesses. The implications? More rigorous record-keeping obligations imposed on taxpayers and legitimization of Bitcoin under the eyes of regulators.

The Case for Clarity

The absence of cohesive regulatory clarity continues to hinder Bitcoin’s adoption within the US. While strict regulation could stymie innovation, concise rules might instill confidence in investors and cement Bitcoin’s role in the economy.

Bitcoin’s Influence on Traditional Financial Institutions and the Future of Banking

Bitcoin didn’t just disrupt money—it reformulated how financial institutions operate and innovate.

The Threat to Banks

Bitcoin is decentralized in that it provides a means of transferring value without the need for an intermediary in the form of a bank. This has forced mainstream financial institutions to reevaluate their approaches to remain competitive.

Blockchain Technology Adoption

Banks have started using blockchain, which is the technology underpinning Bitcoin for faster, safer and cost-effective transactions. For example, JPMorgan has created its own blockchain-based solutions, demonstrating the impact of Bitcoin on the industry.

The Future of Decentralized Finance (DeFi)

Bitcoin was the gateway drug to decentralized finance (DeFi), an ecosystem of financial applications that are non-custodial and operate without banks or intermediaries. As a result, we could see banking of the future be very different from any of the institutions we know today with growing focus on P2P (peer-to-peer) lending, tokenization of assets, and smart contracts.

Practical Advice for First-Time Bitcoin Buyers and Investors

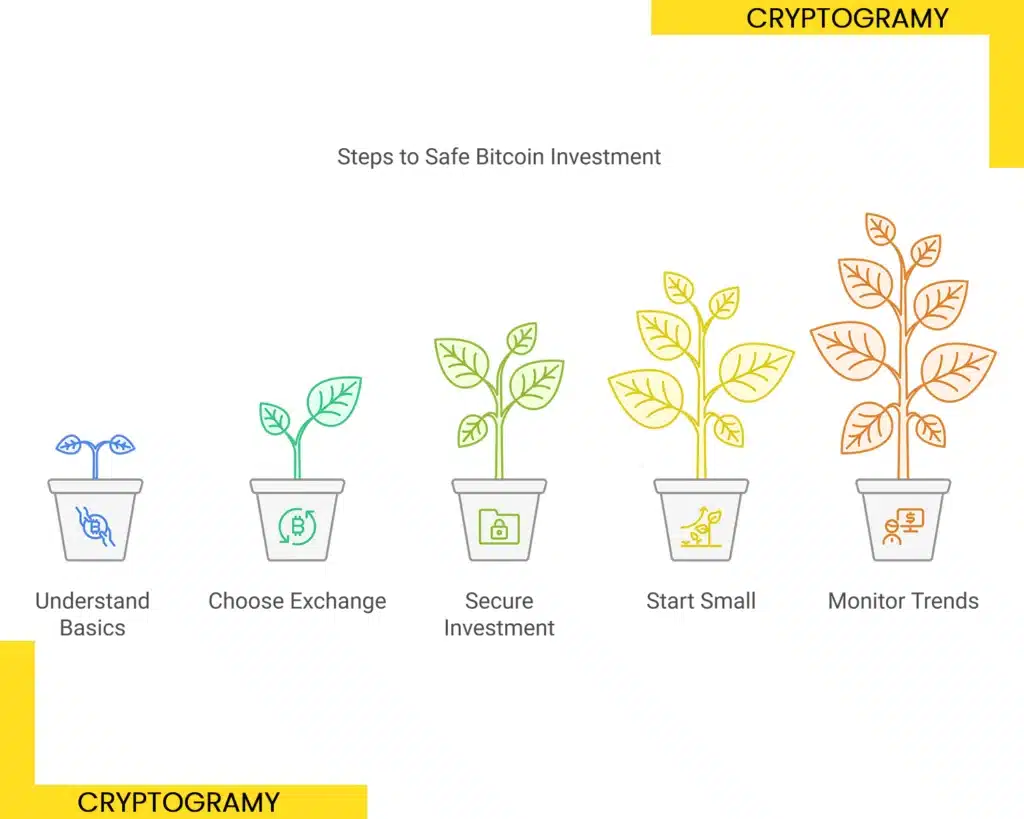

Interested in dipping your toes into Bitcoin? Here’s how to get started safely and strategically.

1. Understand the Basics

Don’t invest in what you don’t understand. Familiarize yourself with Bitcoin, blockchain, and wallet options.

2. Choose a Trustworthy Exchange

Opt for reputable platforms like Coinbase, Kraken, or Gemini to buy Bitcoin safely.

3. Secure Your Investment

Invest in a reliable digital wallet to store your Bitcoin. Hardware wallets provide enhanced security against hacking attempts compared to online wallets.

4. Start Small

Bitcoin’s volatility can be intimidating, so start with a modest investment and gradually increase as you gain confidence.

5. Monitor Market Trends

Stay updated on Bitcoin market trends, regulatory news, and technological advancements that could impact its value.

What Lies Ahead for Bitcoin and the US Economy

There is no indication that Bitcoin’s unprecedented ascendency to the world stage is slowing down. For the US, this is both an opportunity and a challenge. As it becomes a more prominent part of the financial landscape, its ability to affect traditional economies cannot be overstated.

Whether you’re an investor seeking to diversify or an inquisitive economics buff, the story of Bitcoin is worth following closely. Its function in encouraging innovation, defining financial inclusion, and even challenging fiat currencies makes it central to economic discussions.

If you feel prepared to join the crypto revolution, there’s no time like the present to learn, invest wisely, and prepare for what many believe to be the future of money.