What are the different types of cryptocurrency available in 2024?

Cryptocurrency has grown from a niche digital asset to a global phenomenon. As of 2024, thousands of cryptocurrencies are in circulation, each with unique features and use cases. Whether you’re an investor, a blockchain enthusiast, or someone new to the world of digital currencies, understanding the different types of cryptocurrencies is crucial for navigating this space.

This article will explore today’s cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and stablecoins. We will also delve into how these cryptocurrencies differ from one another and the role each plays in the ever-evolving digital economy.

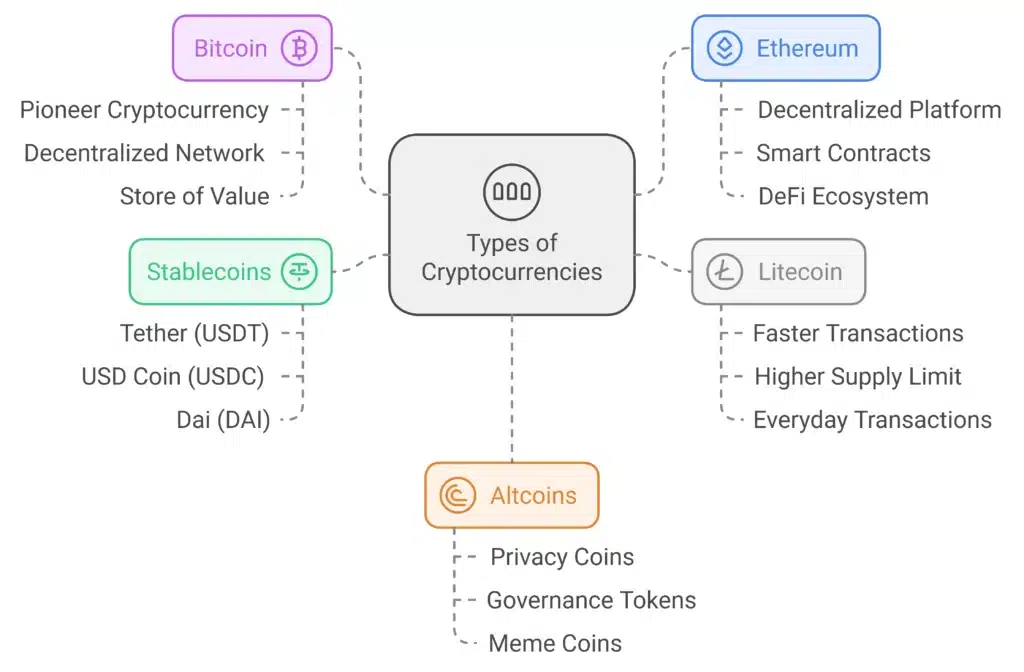

Types of Cryptocurrencies: An Overview

Cryptocurrencies can be divided into several categories, each with distinct features. Some of the most common categories include:

1. Bitcoin (BTC) – The Pioneer Cryptocurrency

Bitcoin, created in 2009 by an anonymous person (or group) known as Satoshi Nakamoto, is the first and most well-known cryptocurrency. It operates on a decentralized network called the Bitcoin blockchain. Bitcoin has set the standard for all other cryptocurrencies and is often referred to as digital gold due to its store of value attributes.

2. Ethereum (ETH) – The Smart Contract Leader

Ethereum is more than just a cryptocurrency; it is a decentralized platform that allows developers to build and deploy smart contracts and decentralized applications (dApps). Ethereum’s Ether (ETH) is the second-largest cryptocurrency by market capitalization and plays a critical role in the DeFi (Decentralized Finance) ecosystem.

3. Litecoin (LTC) – The Silver to Bitcoin’s Gold

Charlie Lee created Litecoin in 2011 as a “lighter” version of Bitcoin. While it shares many similarities with Bitcoin, such as the use of blockchain technology, Litecoin offers faster transaction speeds and a higher supply limit. This makes it a popular choice for smaller, everyday transactions.

4. Stablecoins – The Stable Digital Currency

Stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to a fiat currency or a basket of assets. The most popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI). These digital currencies are often used for trading, remittances, and storing value in volatile markets.

5. Altcoins – A Wide Range of Digital Currencies

Altcoins are all cryptocurrencies other than Bitcoin. They include a variety of coins, tokens, and projects, ranging from Ethereum to lesser-known projects like Cardano (ADA), Polkadot (DOT), and Ripple (XRP). Altcoins can be further categorized into several groups, such as:

- Privacy Coins: Cryptocurrencies like Monero (XMR) and Zcash (ZEC) that focus on enhancing privacy and anonymity in transactions.

- Governance Tokens: Cryptos are used for governance and decision-making within decentralized organizations, such as Uniswap (UNI) or Aave (AAVE).

- Meme Coins: Cryptocurrencies born out of internet memes, like Dogecoin (DOGE) and Shiba Inu (SHIB), which gained popularity as speculative assets.

How Do Different Cryptocurrencies Work?

Each cryptocurrency operates on its underlying blockchain technology, which records and secures all transactions. The primary difference lies in how these blockchains are structured, their consensus mechanisms, and their intended use cases.

Proof of Work vs. Proof of Stake

- Proof of Work (PoW) is the consensus mechanism used by Bitcoin and Litecoin. Miners must solve complex mathematical puzzles to validate transactions and add them to the blockchain.

- Proof of Stake (PoS), used by Ethereum 2.0 and other altcoins, allows participants to validate transactions based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

Layer 1 vs. Layer 2 Blockchains

- Layer 1 blockchains (e.g., Bitcoin, Ethereum) are independent networks.

- Layer 2 solutions (e.g., Lightning Network, Polygon) are built on top of Layer 1 blockchains to improve scalability, speed, and cost-efficiency.

Best Cryptocurrencies to Invest in 2024

As of 2024, some of the best cryptocurrencies to consider for investment include:

1. Bitcoin (BTC) – Due to its established market dominance and limited supply, Bitcoin remains a safe investment for long-term growth.

2. Ethereum (ETH) – With the ongoing transition to Ethereum 2.0, the network is expected to become more scalable and efficient, making it an attractive option for investors.

3. Solana (SOL) – Known for its fast transaction speeds and low fees, Solana is a promising blockchain for decentralized applications and DeFi projects.

4. Cardano (ADA) – Cardano focuses on sustainability and scalability, making it a solid investment for those looking to support blockchain innovations.

Final Thoughts on Cryptocurrency Types

The world of cryptocurrencies is vast and continues to evolve rapidly. Whether you’re interested in the established Bitcoin and Ethereum or looking to explore newer altcoins, understanding the different types of cryptocurrencies will help you make informed decisions.

Before investing:

- Always consider your risk tolerance.

- Research each cryptocurrency’s unique features.

- Keep up with the latest trends in the blockchain and cryptocurrency space.

FAQs About Types of Cryptocurrencies

Q1: What is the difference between Bitcoin and Ethereum?

Bitcoin is primarily a digital currency, while Ethereum offers a platform for creating decentralized applications and smart contracts.

Q2: What are the most popular stablecoins?

Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI), all of which aim to maintain a 1:1 peg with the US dollar.

Q3: Are altcoins worth investing in?

Altcoins offer higher potential returns but come with increased risk compared to Bitcoin. Conduct thorough research before investing in altcoins.

This structure provides detailed insights into the different types of cryptocurrencies.