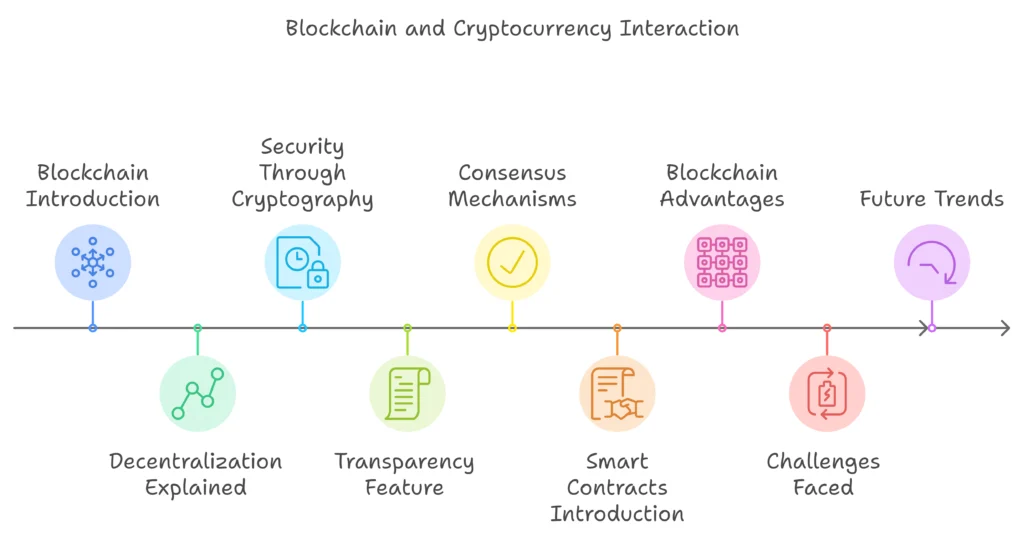

Cryptocurrency has revolutionized our thoughts about money, payments, and even investments. But behind every Bitcoin transfer or Ethereum transaction lies a groundbreaking technology—blockchain. While many people have heard of blockchain, fewer fully understand how it works or how it provides the foundational architecture that makes cryptocurrencies secure, transparent, and decentralized. If you’re an investor or a tech enthusiast eager to learn more about the symbiotic relationship between blockchain and cryptocurrency, this guide is tailored for you.

What Is Blockchain?

To understand blockchain’s role in cryptocurrency, we first must define blockchain. At its core, blockchain is a decentralized digital ledger. Instead of being stored on a single server or central database, blockchain spreads data across a network of computers—known as nodes—that work together. Each “block” in the blockchain contains three main components:

- Data (this could be transaction details, for instance).

- A unique identifier is called a hash.

- The hash of the previous block links them in chronological order.

Because every block is connected to the one before, the system forms an immutable “chain” of records. This structure is what underpins blockchain’s security, transparency, and decentralization. Blockchain records are tough to alter and accessible to anyone in the network, creating an open but secure way to verify data.

That’s all well and good, but where does cryptocurrency come into play?

Cryptocurrency’s Foundation in Blockchain

When Bitcoin was introduced in 2009, it disrupted financial norms with its promise of peer-to-peer transactions, bypassing traditional intermediaries like banks. Blockchain technology was the key innovation that made Bitcoin—and every cryptocurrency since—possible. Here’s how blockchain underpins the functionality of cryptocurrency:

1. Decentralization

Traditional financial systems rely on centralized authorities, like banks, to process and verify transactions. Blockchain flips this system on its head. Instead of an intermediary managing transactions, the blockchain network collectively verifies and processes them. Every participant in the blockchain network (who chooses to operate a node) has access to the latest copy of the ledger, ensuring no single entity has control over the data.

This decentralization is synonymous with freedom for investors and advocates of decentralized finance (DeFi). It removes the dependency on traditional institutions and empowers individuals to take control of their financial assets.

2. Security Through Cryptography

Blockchain employs cryptographic techniques to secure every transaction. Every time a cryptocurrency transaction occurs, it is grouped with other transactions into a block. Before this block can be added to the blockchain, it must be verified through a process called consensus (more on this later), and its data must be encrypted to ensure it cannot be tampered with.

Thanks to cryptographic hashing, any attempt to alter the transaction data would invalidate the entire block, alerting everyone in the network. This means peace of mind for cryptocurrency users—their digital assets are secure from fraud or unauthorized alterations.

3. Transparency

One of blockchain’s defining features is its transparency. Every cryptocurrency transaction is recorded on the blockchain for all participants to see. While users’ identities are kept private through pseudonyms (long alphanumeric addresses), the transaction details—such as the amount and wallet addresses involved—are public.

For investors and tech enthusiasts, this transparency builds trust. It allows participants to verify transactions without relying on opaque third parties, making blockchain technology the foundation for a trustworthy and accountable financial system.

4. Consensus Mechanisms and Validation

Cryptocurrencies operate on the rule of consensus. All network participants must agree that a transaction is valid before being added to the blockchain. Different cryptocurrencies use different consensus mechanisms:

- Proof of Work (PoW): Like Bitcoin, PoW requires participants (miners) to solve complex mathematical puzzles. This process ensures that only legitimate transactions are added but requires significant computational power.

- Proof of Stake (PoS): Popular with newer cryptocurrencies like Ethereum 2.0, PoS relies on participants (validators) staking their cryptocurrency as collateral, reducing energy consumption.

These consensus mechanisms prevent fraud, double spending, and malicious practices, creating a stable foundation for cryptocurrency’s success.

5. Smart Contracts and Programmability

Ethereum, Bitcoin’s younger sibling, introduced an additional layer of functionality to the blockchain with smart contracts. These self-executing contracts, where the terms of agreement are written into the code, automatically verify and execute transactions when conditions are met. For example, smart contracts can manage decentralized finance platforms, allowing lending, borrowing, or trading cryptocurrency without intermediaries.

This programmability has enabled blockchain to go beyond cryptocurrency and into broader industries like healthcare, supply chain, and gaming, boosting its relevance and utility for cryptocurrency users.

Blockchain’s Advantages for Cryptocurrency Investors

If you’re investing in cryptocurrency, blockchain’s technological strengths should give you confidence in your assets. Here are the top advantages blockchain provides to crypto investors:

1. Immutability

Once a transaction is verified and added to the blockchain, it becomes permanent. This prevents tampering or fraud, reinforcing reliability in the crypto markets.

2. Reduced Costs

By removing intermediaries and transaction fees imposed by financial institutions, blockchain reduces the cost of cross-border payments and trading. Cryptocurrency investors can enjoy faster, cheaper global transactions.

3. Accessibility

Blockchain operates globally and 24/7. Anyone with a smartphone and an internet connection can access the cryptocurrency system, breaking down barriers for unbanked populations.

4. Diversification with Tokenization

Blockchain enables tokenization—representing real-world assets like real estate, stocks, or art as digital tokens on the blockchain. This opens new avenues for crypto investors to diversify their portfolios.

Common Challenges of Blockchain in Cryptocurrency

While blockchain brings immense benefits to cryptocurrency, challenges remain. These include:

- Scalability: High transaction volumes can overwhelm specific blockchains, leading to delays and higher fees (e.g., Bitcoin’s blockchain during peak times).

- Energy Consumption: PoW consensus mechanisms consume significant energy, raising concerns about environmental impact.

- Regulation: Governments worldwide are still figuring out how to regulate blockchain and cryptocurrency, creating uncertainty for investors.

Solutions like the transition to more energy-efficient consensus mechanisms (e.g., Ethereum’s move to PoS) and Layer-2 scaling solutions address these issues, making blockchain increasingly viable for the long term.

The Future of Blockchain and Cryptocurrency

Blockchain technology continues to evolve, shaping the future of finance and beyond. Emerging trends such as decentralized finance (DeFi), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs) are all underpinned by blockchain innovation.

As a tech enthusiast or investor, understanding how blockchain supports cryptocurrency is more crucial than ever. Whether diversifying your portfolio or exploring the technical foundations, blockchain offers unmatched potential for secure, transparent, and decentralized systems.

Next Steps

Are you interested in exploring how blockchain and cryptocurrency can revolutionize the way you interact with finance? There’s no better time to begin your blockchain journey. Start by deepening your understanding of various blockchain networks and the cryptocurrencies they support. Whether you’re an experienced investor or just starting, staying informed is key to success in this rapidly evolving space.