Investing in cryptocurrencies has evolved from highly speculative trading to strategic ways of earning sustainable returns, and cryptocurrency staking is leading the charge. But what exactly is staking? How does it work? And, more importantly, how can it help you build passive income?

If you’re seeking creative passive income strategies, are interested in financial investing, or are a crypto enthusiast, this guide will walk you through everything you need to know about maximizing returns through cryptocurrency staking.

What is Cryptocurrency Staking?

Cryptocurrency staking is a method of earning rewards by locking up a certain amount of your crypto assets to support a blockchain network’s operations. This process helps validate and secure transactions on proof-of-stake (PoS) blockchains.

Unlike mining, which requires high-powered equipment and consumes vast energy, staking involves holding funds in a digital wallet to earn higher yields over time.

How does staking work?

When you stake your cryptocurrencies, they are actively put to work within a blockchain network to help validate transactions. Stakers, referred to as “validators,” are rewarded with additional cryptocurrency in exchange for their efforts—imagine it as earning interest on a savings account. However, the reward rates are significantly more lucrative than traditional banking methods.

Why Choose Cryptocurrency Staking for Passive Income?

There are several compelling reasons why cryptocurrency staking is one of the fastest-growing passive income strategies among financial investors.

Higher returns compared to traditional investments

While savings accounts and bonds offer low interest rates, many staking platforms provide an annual percentage yield (APY) ranging from 5% to 15%, and sometimes even higher, depending on the network and asset volatility.

For example, Ethereum staking can yield 4-10%, while smaller blockchains like Polkadot and Cardano offer even higher rewards.

An environmentally friendly alternative to mining

Staking consumes considerably less energy than traditional crypto mining. This makes it an attractive option for environmentally conscious investors who want to profit from crypto.

Passive income potential with minimal effort

Once set up, staking generally requires little to no additional involvement from the investor. This makes it a reliable, hands-off method for growing crypto assets while you focus on other investments or priorities.

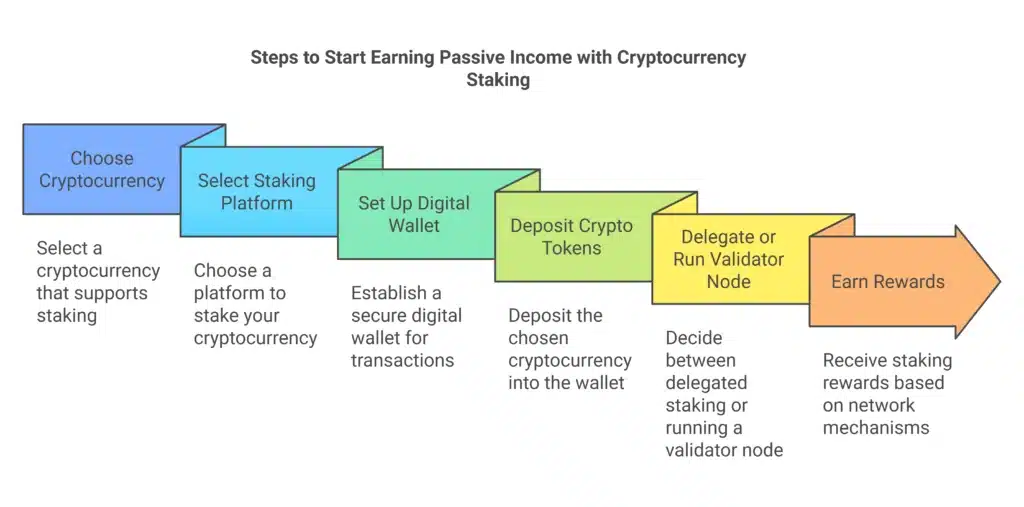

6 Steps to Start Earning Passive Income with Cryptocurrency Staking

Interested in staking? Follow this simple step-by-step guide to get started and maximize your returns.

Step 1: Choose the Right Cryptocurrency for Staking

Not all cryptocurrencies support staking—only those backed by a Proof-of-Stake (PoS) consensus mechanism are eligible. Popular options include:

Research each cryptocurrency to understand its staking APY, market potential, and long-term sustainability.

Step 2: Select a Reliable Staking Platform

You’ll need a platform to stake your cryptocurrency. Some popular staking platforms include:

When choosing a platform, you should consider fees, user experience, security, and staking rewards.

Step 3: Set Up Your Digital Wallet

To stake digital assets, you’ll need a secure digital wallet. Options include hot wallets (connected to the internet) or cold wallets (offline), offering enhanced security.

Hot wallets like MetaMask are ideal for regular transactions, whereas hardware wallets like Ledger offer cold storage solutions to prevent hacking risks.

Step 4: Deposit Crypto Tokens

Once your wallet is set up and connected to a platform, deposit the cryptocurrency you wish to stake. Ensure you meet the platform’s minimum staking requirements—for instance, staking Ethereum on Ethereum 2.0 requires depositing at least 32 ETH.

Step 5: Delegate or Run Your Own Validator Node

There are generally two methods of staking cryptocurrency:

- Delegated staking involves temporarily assigning your tokens to an existing validator. This is simple, beginner-friendly, and doesn’t require technical expertise.

- Running a validator node allows you to validate transactions independently. While this means higher rewards, it’s technically demanding and requires sufficient hardware and expertise.

Step 6: Sit Back and Earn Rewards

Once your staking is live, you can only wait. Rewards are distributed based on the cryptocurrency network’s payout mechanisms, which could range from daily to weekly intervals.

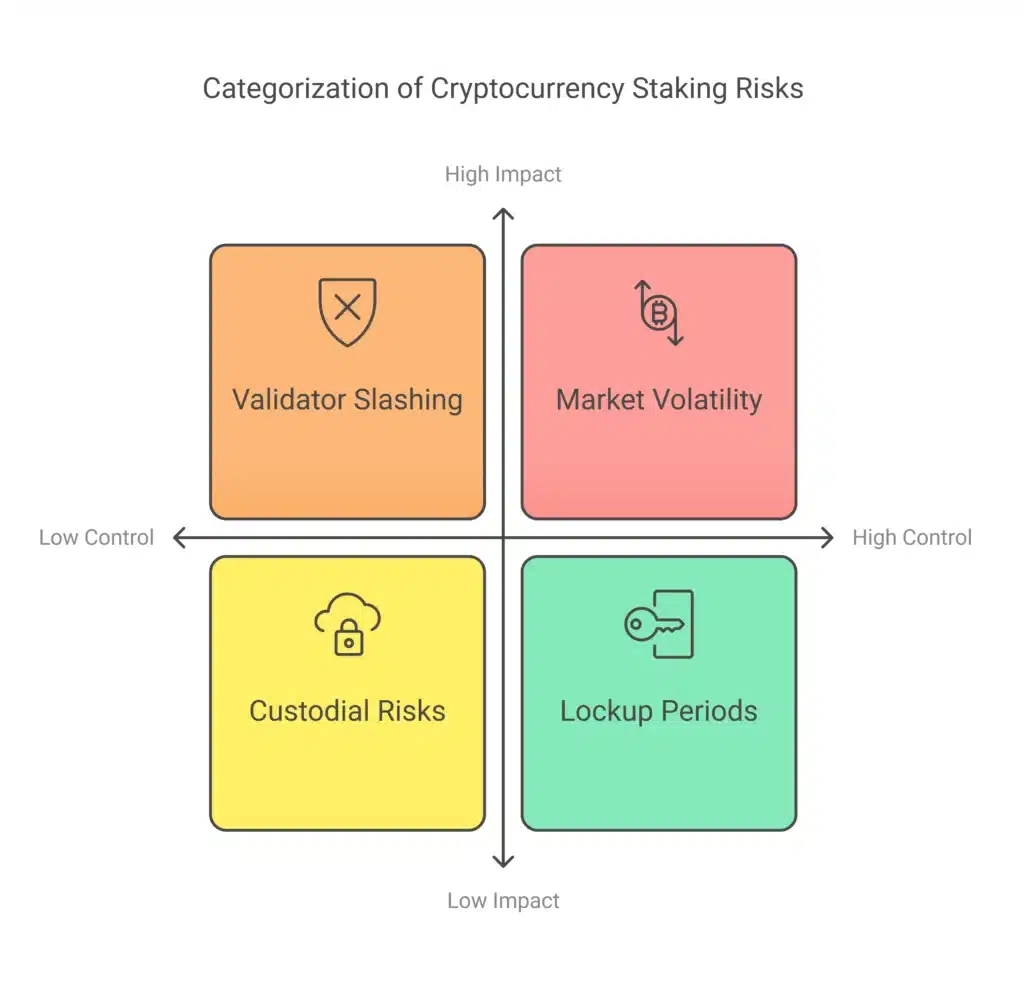

Risks to Keep in Mind

While cryptocurrency staking offers attractive opportunities, knowing possible risks is essential to making well-informed decisions.

- Market Volatility

Cryptocurrency prices are notorious for their volatility. Even if staking rewards are lucrative, a sudden dip in a coin’s value could offset those earnings.

- Lockup Periods

Some staking platforms require you to lock up your tokens for a fixed period, during which you cannot withdraw or trade them.

- Validator Slashing

If you stake through a validator who acts maliciously (e.g., attempting to approve fake transactions), you could face penalties, such as losing some of your staked tokens.

- Custodial Risks

Using an exchange or staking service means someone else holds your cryptocurrency, exposing you to platform security and management risks.

Maximize Your Staking Opportunities

Here are a few tips to enhance your experience and earnings from cryptocurrency staking:

- Diversify your staked assets across multiple PoS cryptocurrencies to spread out risk.

- Opt for reputable platforms with insurance or slashing protection measures.

- Continuously track blockchain updates—evolving consensus changes could impact your rewards.

- Reinvest rewards earned to benefit from compound interest over time.

Which Cryptocurrency Staking Strategy is Right for You?

The best strategy depends on financial goals, risk tolerance, and technical know-how. For passive income seekers, delegated staking often works best due to its ease and minimal setup complexity. Crypto enthusiasts with more time and resources can explore running validator nodes for higher yields.

Discover the Power of Passive Income

Cryptocurrency staking offers an exciting opportunity to grow your wealth hands-free. Whether new to crypto or a seasoned investor, staking is a reliable way to put your digital assets to work. With high yields and innovative platforms simplifying the process, it is time to explore staking to unlock its full potential.

Start implementing this strategy today by researching staking coins and platforms that fit your investment goals.