Cryptocurrency has revolutionized how we think about money, offering decentralization, transparency, and security like never before. Yet, for investors and beginners alike, one core question often arises—where do you store your cryptocurrency securely? The answer lies in cryptocurrency wallets.

Whether you’re a seasoned investor or just dipping your toes into the crypto pool, understanding cryptocurrency wallets is essential for managing and protecting your digital assets. This post will explain cryptocurrency wallets, how they work, and how to choose the right one for your needs.

What is a Cryptocurrency Wallet?

Simply put, a cryptocurrency wallet is a tool that allows you to store and manage your digital assets, like Bitcoin, Ethereum, or any other cryptocurrency. However, contrary to popular belief, a crypto wallet doesn’t physically store your cryptocurrency. Instead, it houses the private and public keys that allow you to access and manage your digital assets on the blockchain.

Think of it like a safe deposit box. While the box doesn’t hold cash, it provides access, ensuring your funds are secure and accessible only to you.

Types of Cryptocurrency Wallets

Cryptocurrency wallets come in two main categories:

- Hot Wallets

Hot wallets are connected to the internet and are known for their convenience. They allow you to access your digital assets quickly, making them ideal for frequent transactions or trading. Examples of hot wallets include mobile, desktop, and web wallets.

- Examples: MetaMask, Trust Wallet, Coinbase Wallet

- Best For: Short-term storage or active trading

- Considerations: Higher vulnerability to hacking due to internet connectivity.

- Cold Wallets

Cold wallets operate offline, enhancing their security features. They are less convenient for frequent trading but offer maximum protection against hacking or cyber theft, making them a preferred choice for long-term investors.

- Examples: Hardware wallets like Ledger Trezor, Paper Wallets

- Best For: Long-term storage and significant holdings

- Considerations: The physical safety of the wallet is critical.

Private Keys, Public Keys, and Your Wallet

Every cryptocurrency wallet manages two essential keys:

- Public Key: Similar to an account number, this is your wallet’s address, which you can share with others to receive funds.

- Private Key: Think of this as the password to your wallet. It must be kept secure and confidential, as it provides access to your cryptocurrency.

Losing your private key is equivalent to losing access to your funds. This is why backup and safekeeping are so crucial in crypto.

How Do Cryptocurrency Wallets Work?

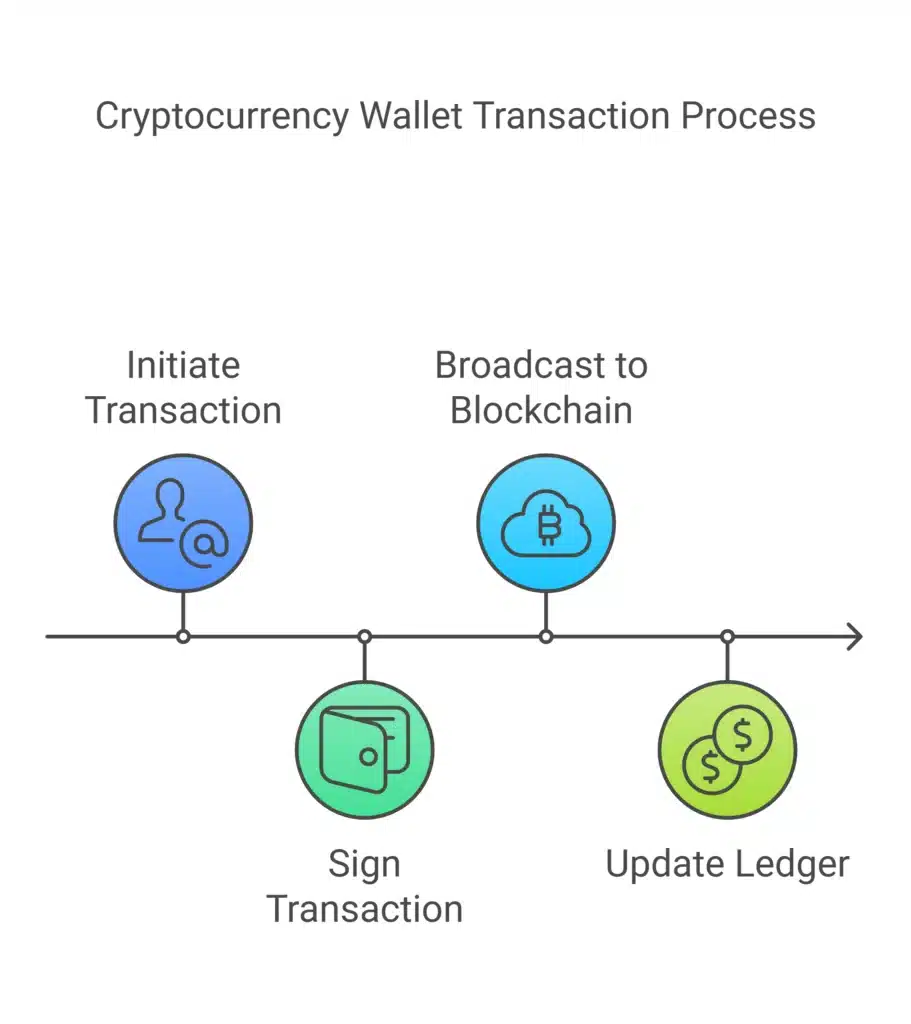

At their core, cryptocurrency wallets interact with blockchain technology to facilitate transactions. Here’s how it works step-by-step:

- Initiate a Transaction

To send cryptocurrency, you initiate a transaction using your wallet. You’ll need the recipient’s public key (or wallet address).

- Sign the Transaction

Your wallet signs the transaction using your private key, validating that you are the rightful owner of the cryptocurrency being sent.

- Broadcast to the Blockchain

Once signed, the transaction is broadcast to the blockchain network, where miners or validators verify it.

- Update the Ledger

After confirmation, the blockchain updates its ledger to reflect the transaction. The recipient’s wallet will now show the newly received cryptocurrency.

Benefits of Using Cryptocurrency Wallets

Cryptocurrency wallets aren’t just tools for storage; they offer significant benefits to their users:

- Enhanced Security

By storing your private keys, wallets ensure that you’re the sole person with access to your digital assets. Cold wallets, in particular, reduce online vulnerability.

- Full Control Over Assets

Using your wallet means not relying on a third party, such as an exchange, to safeguard your funds. This eliminates the risk of exchange-related issues, like hacks or closures.

- Customizable Features

Many wallets offer advanced features, such as transaction history, backup options, and integration with decentralized applications (dApps).

How to Choose a Cryptocurrency Wallet

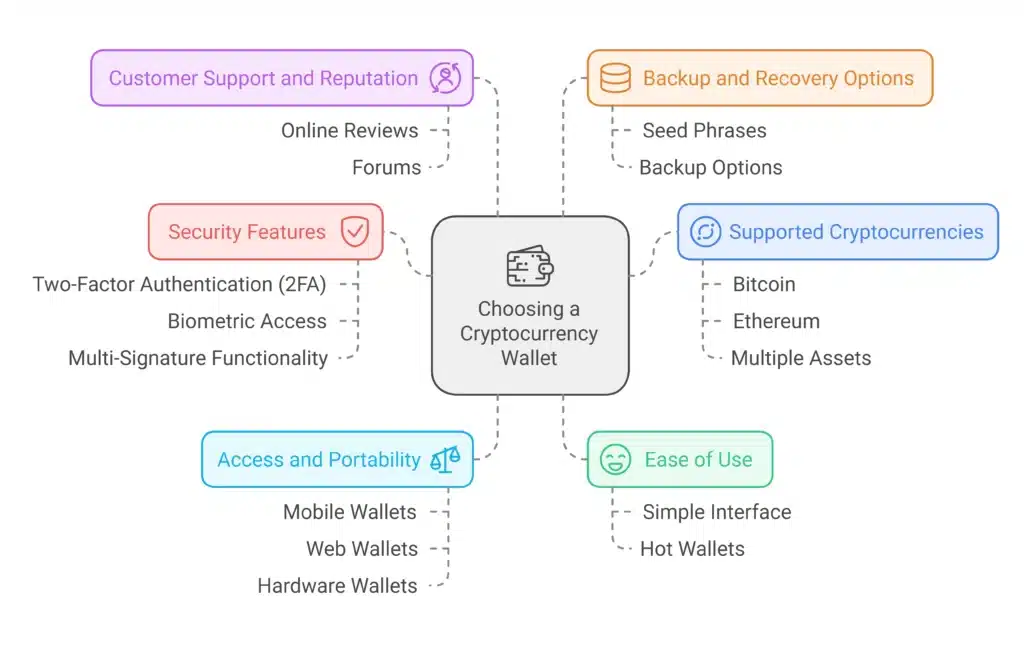

With hundreds of wallet options available, choosing the right one may seem daunting. Here’s what to consider:

- Security Features

To ensure robust protection, look for features like two-factor authentication (2FA), biometric access, or multi-signature functionality.

- Ease of Use

If you’re new to cryptocurrency, opt for a wallet with a simple, user-friendly interface. Hot wallets are typically easier to set up and understand.

- Supported Cryptocurrencies

Make sure the wallet supports the cryptocurrencies you plan to store. Some wallets are designed specifically for Bitcoin or Ethereum, while others support multiple assets.

- Access and Portability

If you frequently access your digital assets or are on the go, a mobile or web wallet may suit your needs. For long-term storage, consider physical hardware wallets.

- Customer Support and Reputation

Check online reviews and forums to learn what other users think about the wallet’s reliability, security, and customer service.

- Backup and Recovery Options

If you lose your wallet access, a reliable recovery process is crucial. Look for wallets that offer seed phrases or backup options.

Common Cryptocurrency Wallet Myths

There are several misconceptions about cryptocurrency wallets:

“I don’t need a wallet; I’ll just leave my crypto on the exchange.”

Exchanges are convenient but only partially secure. With high-profile exchange hacks, it’s risky to store large amounts of cryptocurrency this way.

“All wallets are the same.”

Different wallets offer varying levels of security, features, and usability. Choose one that fits your specific needs.

“If I lose my wallet, I lose my funds.”

That is not true—most modern wallets allow recovery using a seed phrase or backup.

Final Thoughts—Your Crypto Journey Starts Here

Understanding and choosing the right cryptocurrency wallet is crucial to managing your digital assets effectively and securely. Whether you’re actively trading or holding onto your assets for the long term, there’s a wallet ideally suited to your needs.

Looking to take the next step? Start by evaluating your crypto habits and then explore the wide range of wallet options available. Ensure your digital assets are protected and easily accessible.

Cryptocurrency is all about empowerment and independence. The right tools, like a well-chosen wallet, give you the control you need to make the most of this exciting frontier.