NFTs, or Non-Fungible Tokens, are the buzzword sweeping the blockchain and cryptocurrency world. From their meteoric rise in popularity to headline-grabbing auctions worth millions of dollars, NFTs are transforming digital ownership and reshaping how we view digital content. But how exactly do NFTs relate to cryptocurrency? And why are they creating such a stir?

Suppose you’re fascinated by cryptocurrency trends and eager to explore the intersection between technology, finance, and creativity. In that case, this blog will break down everything you need to know about NFTs—what they are, how they work, and their impact on the cryptocurrency market.

NFTs vs. Traditional Cryptocurrencies

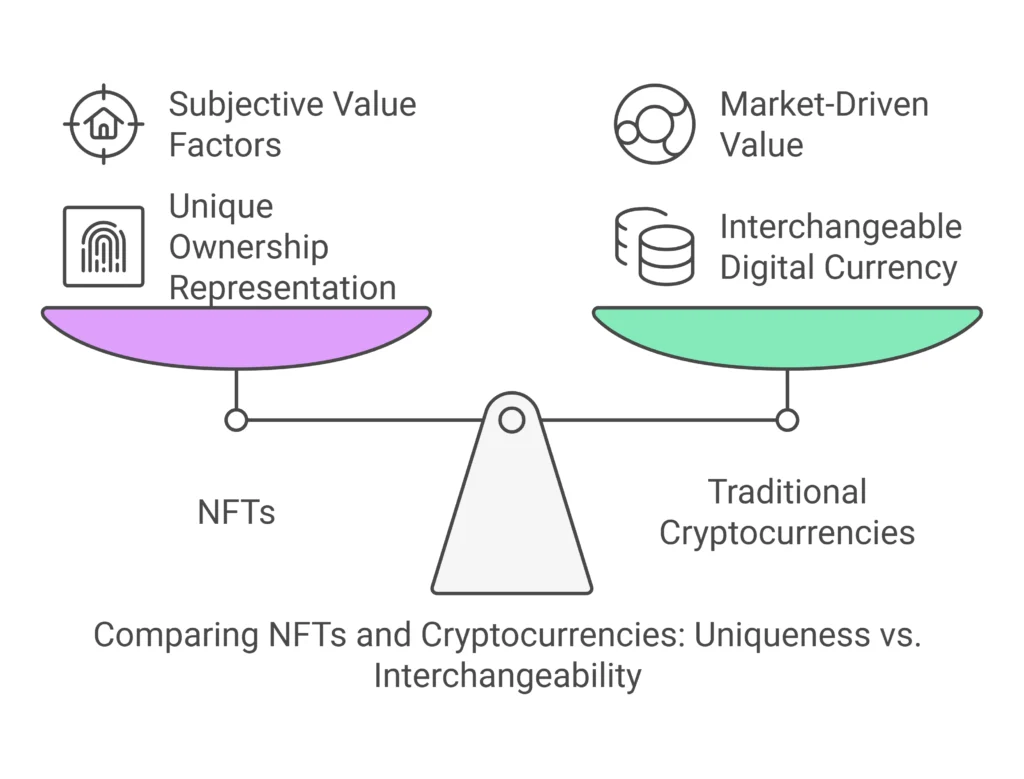

While NFTs and traditional cryptocurrencies like Bitcoin and Ethereum share a home on blockchain networks, they are fundamentally different. Here’s what sets them apart:

Fungibility

Cryptocurrencies are fungible, meaning each unit is interchangeable with another. For example, one Bitcoin equals another Bitcoin in value and function.

NFTs, on the other hand, are non-fungible. Each token is unique, with distinct properties that set it apart. Think of them as digital fingerprints—irreplaceable and one-of-a-kind.

Purpose

Cryptocurrency functions as digital money used for transactions and as a store of value. NFTs, however, are primarily used to represent ownership of digital assets such as artwork, music, videos, virtual real estate, and even in-game items.

Value Foundation

The value of cryptocurrency is often tied to market dynamics, adoption, and utility within ecosystems. Meanwhile, NFT value is usually subjective, based on factors like rarity, demand, creator reputation, and the asset’s perceived cultural significance.

How NFTs Work: The Technology Behind the Buzz

At the heart of NFTs lies blockchain technology. Here’s a closer look at the mechanics powering them:

Blockchain and Smart Contracts

NFTs thrive on blockchain networks, decentralized ledgers that securely record transactions. Ethereum is the most common blockchain for NFTs due to its smart contract functionality, which enables developers to enforce unique characteristics and transactions for each NFT programmatically.

Token Standards

NFTs adhere to specific token standards—most famously ERC-721 or ERC-1155 on Ethereum. These standards define how unique tokens interact with the blockchain, ensuring compatibility across wallets, platforms, and marketplaces.

Proof of Ownership and Authenticity

Each NFT contains a unique identifier stored on the blockchain, acting as undeniable proof of ownership. This authenticity feature prevents duplication, offering peace of mind to creators and buyers alike.

Real-World Applications of NFTs

NFTs aren’t just a digital fad; their applications redefine practices across multiple industries.

Art and Digital Collectibles

Thanks to NFTs, the art world has experienced a seismic shift. Digital artists no longer need galleries to showcase their work. Through platforms like OpenSea and Rarible, creations like Beeple’s “$69 million digital collage” have turned the art world on its head.

Gaming

NFTs are revolutionizing in-game economies by allowing players to own and trade virtual items like skins, weapons, or avatars that can exist outside a specific game environment.

Music and Entertainment

Musicians release albums or exclusive content as NFTs, providing fans with proof of ownership and unique perks like backstage passes or custom tracks. It’s a game-changer for artist-fan relationships.

Virtual Real Estate

Virtual worlds like Decentraland and The Sandbox allow users to buy, sell, or rent virtual property via NFTs. Some virtual land plots are now worth hundreds of thousands of dollars!

Fashion and Wearable Tech

Luxury brands and fashion houses use NFTs to launch limited digital collections, enabling avatar customization in virtual social spaces or games.

Risks and Challenges of NFTs

While the opportunities seem endless, NFTs come with their fair share of challenges:

Environmental Concerns

Blockchain networks consume vast energy, particularly those using Proof of Work (PoW) mechanisms. The environmental impact of NFT minting has become a pressing issue that blockchain developers continue to address.

Copyright and Ownership Clarity

Just because you own an NFT doesn’t mean you own the intellectual property of the asset it represents. Ownership rights are often murky, leading to copyright infringement disputes.

Market Volatility

The NFT market is susceptible to hype cycles, making it inherently volatile. Prices can soar and crash unpredictably, exposing investors to significant financial risks.

Fraud and Scams

From fake NFT listings to phishing scams, the industry’s unregulated nature presents dangers that buyers and creators must remain vigilant against.

How NFTs Impact the Cryptocurrency Market and Economy

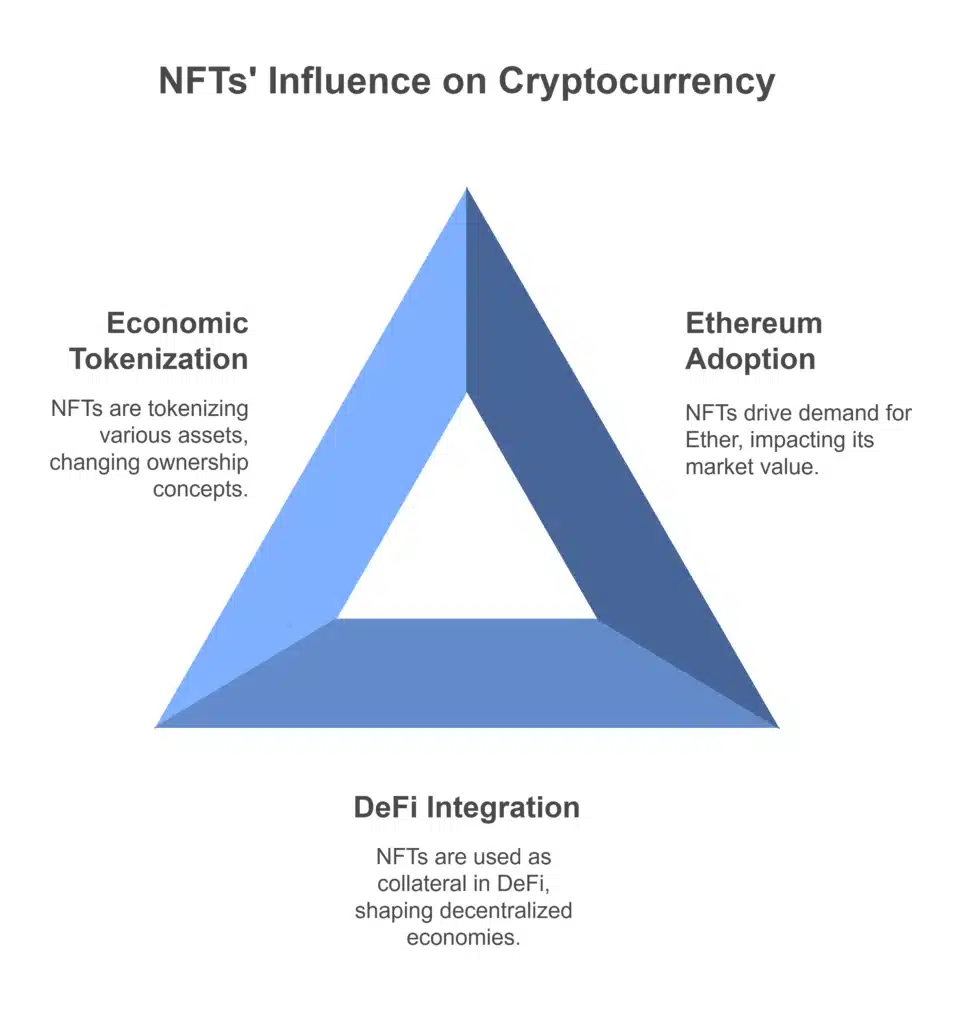

NFTs and cryptocurrency trends are deeply intertwined, influencing each other in several ways:

- Ethereum Adoption

Most NFTs are built on the Ethereum blockchain, driving increased demand for Ether (ETH) to pay for gas fees, which affects ETH’s market value.

- Decentralized Finance (DeFi)

NFTs are increasingly integrated into DeFi applications, such as using NFT art as collateral for crypto loans. This convergence of DeFi and NFTs could shape the future of decentralized economies.

- Tokenizing the Economy

Beyond art and collectibles, NFTs are paving the way for tokenizing real estate, intellectual property, and healthcare assets, altering how we think about asset ownership.

The Future of NFTs

Many believe the current phase of expensive artworks and collectibles is just the beginning. The real potential of NFTs lies in their ability to revolutionize industries through:

- Interoperability and Standardization

Blockchain developers are working on creating ecosystems where NFTs can seamlessly interact across various platforms and applications. This could unlock tremendous utility.

- Enterprise Integration

Enterprises are exploring NFTs for supply chain transparency, credential verification, and customer loyalty programs. These use cases could bring NFTs into mainstream adoption.

- Layer 2 Solutions and Energy Efficiency

Sustainable blockchain practices, such as Ethereum’s shift to Proof of Stake (PoS) in Ethereum 2.0 and adopting Layer 2 scalability solutions, will alleviate environmental concerns while reducing transaction fees.

Why NFTs Matter More Than Ever

NFTs represent a paradigm shift in how we think about ownership, authenticity, and value in the digital age. Whether you’re an investor, creator, or enthusiast, understanding their relevance to cryptocurrency trends gives you a competitive edge in navigating a rapidly evolving financial landscape.