Bitcoin remains the king of the headline as the world’s best-known cryptocurrency. Predicting Bitcoin future price potential is critical in developing success strategies for investors, financial analysts and crypto enthusiasts.

But what will Bitcoin look like in 2025? Will it surge into new record high territory or are we in for a market correction?

In this post we delve into Bitcoin predicting price in 2025 quoting expert opinions, historical trends, and the important variables that could affect Bitcoin’s trajectory. If you’re wondering whether to buy, sell or hold, read on — we’ll break down everything you need to know.

The Current State of Bitcoin in the Market

Between Ethereum and Bitcoin, Bitcoin, being the largest cryptocurrency with a market cap of over $500 billion, draws tremendous interest. For many, it is perceived as digital gold — an asset for long-term investment and wealth storage.

Bitcoin has this reputation though, hardly stable by any means. Its price often moves wildly, posing both opportunities and threats for those who invest in it. In this respect, it closely resembles traditional assets which are volatile by nature — Bitcoin, for example, reached $69,000 in 2021 before plummeting to less than $20,000 in 2022, which is a typical example of its volatility.

Today, Bitcoin floats between $25,000 and $30,000, and market analysts are still guessing where it will go next.

A Look Back at Bitcoin’s Price Trends

To understand Bitcoin’s future, we need to examine its past. Since its launch in 2009, Bitcoin’s price trajectory can be divided into notable boom-and-bust cycles often tied to these factors:

- Adoption milestones (e.g., institutions adopting crypto for payments)

- Halving events (when Bitcoin’s mining rewards are cut in half)

- Market sentiment is driven by external news or crypto regulations

Key Milestones

- 2010–2013: The early years saw explosive growth, with Bitcoin rising from virtually nothing to over $1,000.

- 2014–2017: Market adoption began, topped by the 2017 bull market, where Bitcoin hit $19,000 for the first time.

- 2018–2020: A market correction followed, but institutional interest resurged, driving increasing legitimacy.

- 2021: Bitcoin reached its peak ($69,000) due to mainstream adoption and growing enthusiasm for blockchain technology.

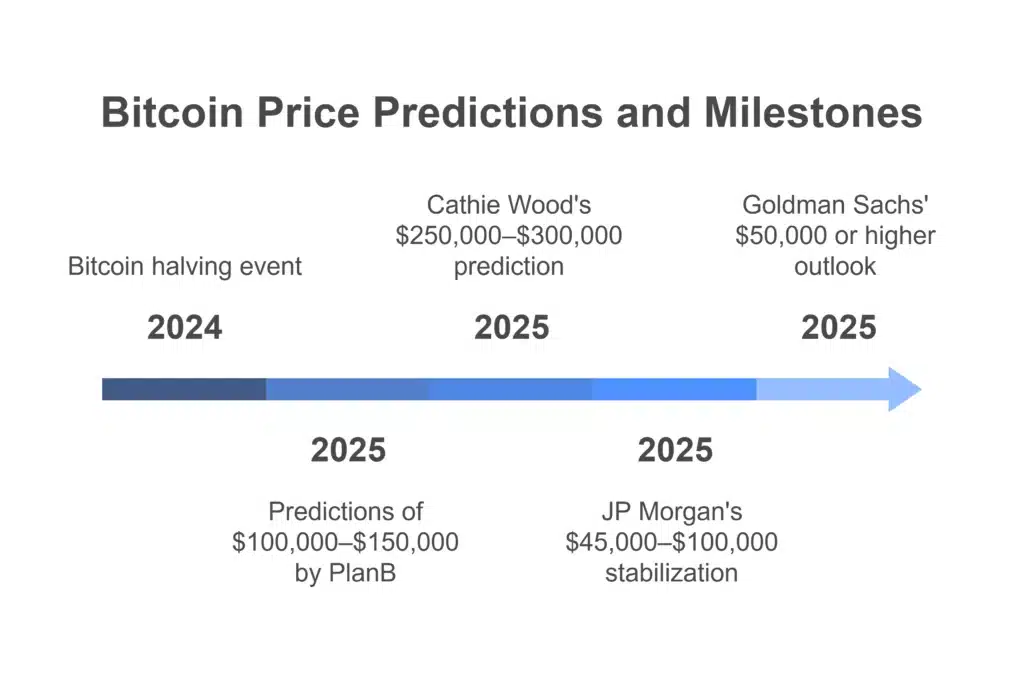

Expert Expectations for Bitcoin Price in 2025

The burning question is whether Bitcoin will outperform itself post-2025. Several experts have shared their predictions. Here’s what they’re saying about Bitcoin price 2025 trends:

Cathie Wood (ARK Invest)

Wood’s ARK Invest predicts Bitcoin could climb as high as $1 million by the end of this decade based on increasing institutional adoption and limited supply. For 2025, it suggests the price could touch $250,000–$300,000 if adoption grows steadily.

JP Morgan

One of the prominent financial institutions that has pivoted to Bitcoin, JP Morgan, estimates that, based on demand from institutional clients, Bitcoin could stabilize between $45,000 and $100,000 in the next 2–3 years.

PlanB (Stock-to-Flow Model)

A well-known Bitcoin evangelist, PlanB leverages the Stock-to-Flow model, which predicts Bitcoin touching $100,000–$150,000 post-2024 due to the next halving event, reducing Bitcoin’s supply issuance.

Goldman Sachs

Another Wall Street giant, Goldman Sachs, sees Bitcoin as a potential competitor to gold, indicating it could reach $50,000 or higher depending on macroeconomic conditions.

While optimistic, experts caution that excessive volatility and unanticipated regulatory challenges could slow acceleration.

Factors Influencing Bitcoin Price by 2025

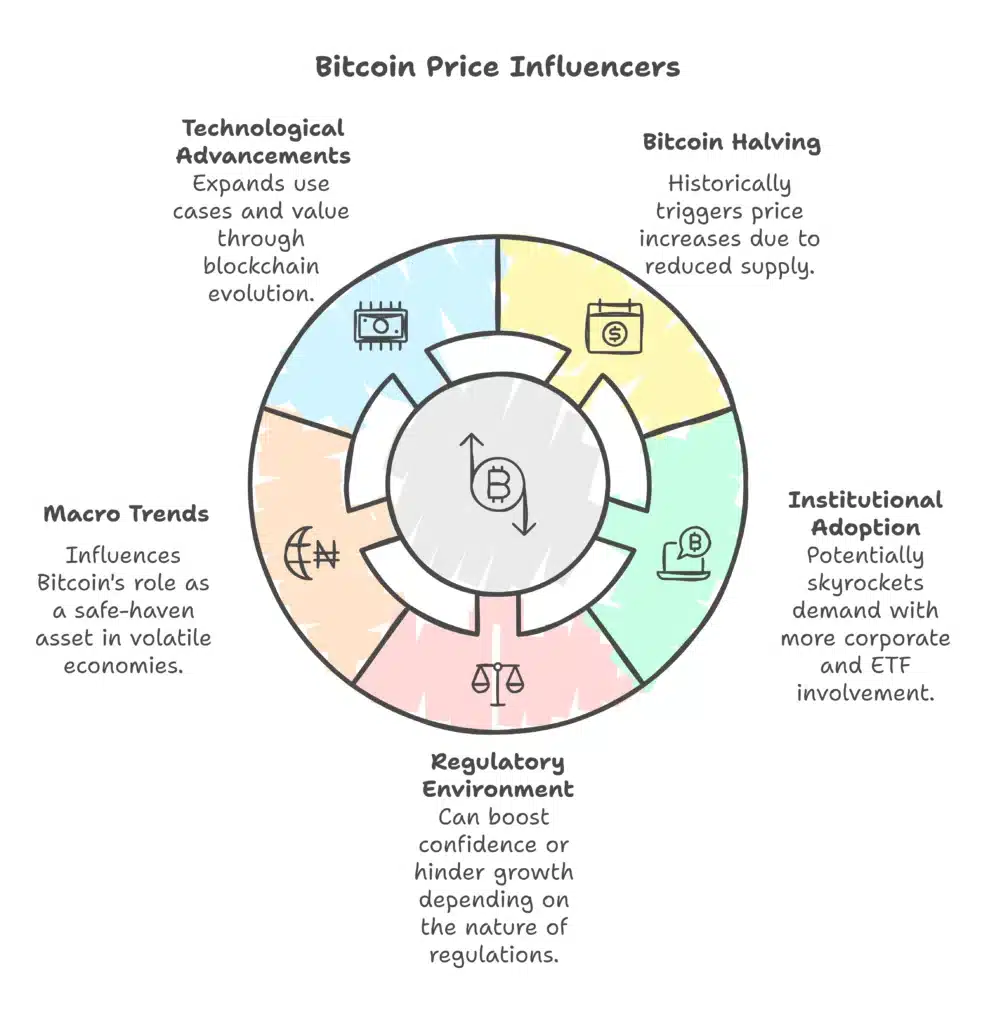

What will genuinely drive Bitcoin’s price? A variety of factors play into its future trajectory:

Bitcoin Halving in 2024

Bitcoin’s halving event—scheduled every four years—reduces the supply of new coins entering the market. Historically, halving has been a bullish trigger, increasing scarcity and higher prices.

Institutional Adoption

Corporations like Tesla and Square have already dipped into Bitcoin. If more institutions join or governments approve Bitcoin ETFs, demand could skyrocket.

Regulatory Environment

Governments worldwide are working on crypto regulations. While precise regulation could boost confidence, aggressive restrictions might hinder growth.

Macro Trends

Factors like inflation and the strength of traditional currencies play a significant role. For instance, Bitcoin often acts as a safe-haven asset in economies where inflation is high.

Technological Advancements

The continued evolution of blockchain—whether through Bitcoin or adjacent technologies like Ethereum—might spark more use cases, increasing its value.

Balancing Risks & Opportunities in Bitcoin Investment

Bitcoin comes with both considerable rewards and significant risks. Here’s how to weigh your decision in 2025.

Risks

- Regulation Uncertainty: Bans or legal restrictions could hinder mainstream adoption.

- Volatility: Price swings might result in losses for short-term investors.

- Competition: Emerging cryptocurrencies (e.g., Ethereum, Solana) could steal Bitcoin’s limelight.

Opportunities

- Store of Value: Bitcoin remains one of the most reliable assets for preserving wealth in the long term.

- Institutional Adoption: Increased adoption amplifies Bitcoin’s legitimacy and demand.

- Global Trends: Bitcoin’s resilience during economic instability makes it attractive as a decentralized currency.

What Lies Ahead? Key Takeaways

Bitcoin’s price in 2025 remains a subject of intense debate. However, patterns suggest that Bitcoin isn’t going anywhere—it will remain a crucial player in the financial ecosystem.

Whether it breaks through $250,000, stabilizes near $100,000, or sees new regulatory challenges, Bitcoin offers a unique opportunity for those willing to balance risk and reward.