Introduction: How Do I Start Trading Cryptocurrency for Profit?

Cryptocurrency trading has become one of the most popular ways to earn profits in the digital world. With various cryptocurrencies like Bitcoin, Ethereum, and altcoins, the potential for profitable trades has attracted millions of investors. However, entering the crypto market can be overwhelming for beginners. This guide will help you understand the basics and strategies for starting to trade cryptocurrency for profit.

Understanding Cryptocurrency Trading: The Basics

Before diving into the world of crypto trading, it’s essential to understand what cryptocurrency is and how trading works. Cryptocurrency is a decentralized digital asset that uses blockchain technology for secure transactions. Trading involves buying and selling these digital currencies on platforms to make a profit.

What is Cryptocurrency?

Cryptocurrency is a form of digital money that operates on blockchain technology. Unlike traditional currencies, it is not regulated by a central authority like a government or bank.

How Does Cryptocurrency Trading Work?

Crypto trading involves buying digital currencies at a low price and selling them when their value increases. The profit comes from the difference in cost between the buying and selling points.

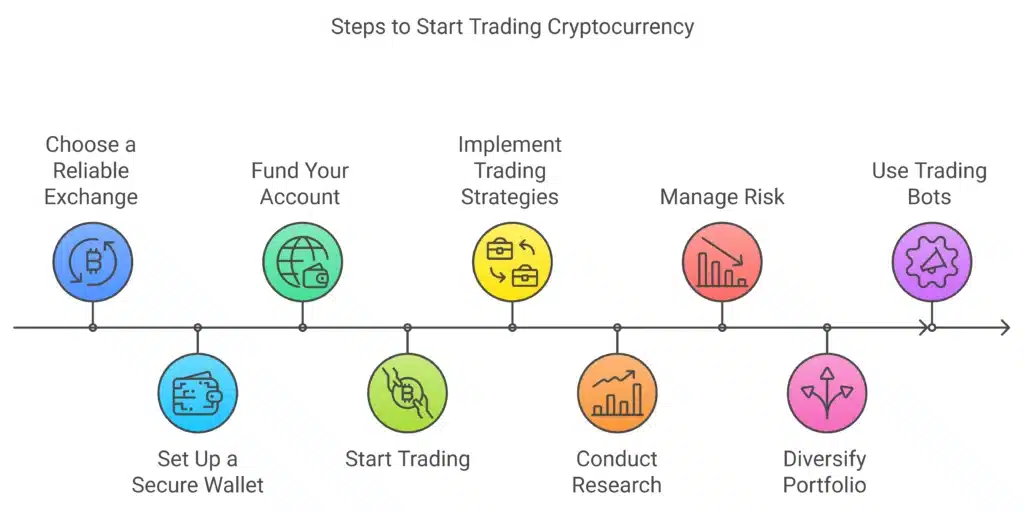

1. Steps to Start Trading Cryptocurrency for Profit

Step 1: Choose a Reliable Cryptocurrency Exchange

To start trading, you’ll need a cryptocurrency exchange where you can buy and sell your digital assets. Some of the most popular exchanges include Coinbase, Binance, and Kraken. Make sure to choose an exchange that offers low fees, a user-friendly interface, and a wide variety of coins.

Step 2: Set Up a Secure Wallet

A cryptocurrency wallet is a digital tool that stores your cryptocurrencies safely. You’ll need a wallet to keep your coins secure and ready for trading. There are two main types of wallets: hot wallets (online) and cold wallets (offline). Cold wallets are more secure, but hot wallets are more convenient for active trading.

Step 3: Fund Your Account and Start Trading

Once your exchange account and wallet are set up, you can fund your account using fiat money or other cryptocurrencies. Many exchanges support credit card payments, bank transfers, or even PayPal. After depositing funds, you can start trading by purchasing cryptocurrencies at lower prices and waiting for the right moment to sell.

2. Profitable Crypto Trading Strategies

To maximize your chances of making a profit, it’s crucial to implement effective trading strategies. Here are a few popular approaches:

1. Day Trading Cryptocurrency: Quick Profits with Short-Term Trades

Day trading involves buying and selling cryptocurrencies within a single day to take advantage of small price fluctuations. This strategy requires you to monitor the markets constantly and make quick decisions.

2. Swing Trading: Capitalizing on Market Trends

Swing trading involves holding onto cryptocurrencies for a few days or weeks to profit from medium-term market trends. This strategy is less time-consuming than day trading and can be an excellent choice for beginners.

3. HODLing: Long-Term Investment for Big Returns

HODLing (a slang term derived from “hold”) refers to buying and holding onto cryptocurrencies for the long term. The idea is to buy when prices are low and hold through market fluctuations, hoping for significant long-term growth.

3. Tips for Trading Digital Currencies: How to Maximize Profit

1. Conduct Thorough Research Before Every Trade

Before making any trade, research the cryptocurrency you’re interested in. Understand the technology behind it, its market trends, and recent news that could impact its price.

2. Manage Risk with Stop-Loss and Take-Profit Orders

Using stop-loss and take-profit orders can help manage risk and protect profits. A stop-loss order automatically sells your crypto if its price drops to a certain level, while a take-profit order sells when the price reaches a pre-set target.

3. Keep Track of Market Trends and News

Cryptocurrency markets are heavily influenced by news and global events. Keeping track of news related to regulations, adoption, and technology developments can help you make informed decisions.

4. Diversify Your Portfolio

Avoid putting all your eggs in one basket. Diversify your portfolio by investing in different cryptocurrencies to spread the risk. This way, you’re not overly exposed to the volatility of a single coin.

4. Tools and Resources for Crypto Trading Success

1. Use Trading Bots for Automation

Trading bots can automate the buying and selling, helping you take advantage of opportunities even when you’re not actively monitoring the markets.

2. Follow Crypto Experts and Analysts

Many experienced crypto traders and analysts share valuable insights on Twitter, Reddit, and YouTube platforms. Following these experts can help you better understand market trends and make smarter trading decisions.

Conclusion: Start Trading Cryptocurrency for Profit Today

Trading cryptocurrency for profit requires dedication, knowledge, and a strategic approach. By following the steps outlined in this guide and applying proven trading strategies, you can confidently start your crypto journey. Always stay informed, manage your risks, and never invest more than you can afford to lose.