Cryptocurrency mining—it’s one of the hottest buzzwords in the tech and financial world. With Bitcoin and other digital assets surging, mining has become a topic of intense interest for hobbyists, financial analysts, and tech enthusiasts.

But what is cryptocurrency mining, how does it work, and, most importantly, is it still profitable in 2024? This in-depth guide will answer all your questions while breaking down complex concepts into simple, digestible explanations.

What Is Cryptocurrency Mining?

Cryptocurrency mining is the process of validating and adding transactions to a blockchain, a secure, decentralized ledger. Alongside this, mining introduces new coins into circulation.

To provide a simple analogy, cryptocurrency miners are like auditors who verify sales transactions in a ledger. Their reward for maintaining this decentralized system is cryptocurrency coins like Bitcoin or Ethereum.

The Basics of Blockchain and Mining

At the heart of cryptocurrency mining lies blockchain technology, which ensures transparency and security. Each cryptocurrency has a blockchain consisting of “blocks” with transaction data. Cryptocurrency mining involves solving complex computational puzzles to validate these transactions.

Once a puzzle is solved:

- The transaction is verified and added to a block.

- The block is added to the blockchain.

- The miner receives cryptocurrency as a reward, also called the block reward.

Proof of Work vs. Proof of Stake

It’s worth noting that not every cryptocurrency uses mining. Many digital currencies rely on alternative methods like Proof of Stake (PoS). However, Proof of Work (PoW)—used by Bitcoin and Ethereum (before ETH 2.0)—remains the most well-known mining model. Mining in a PoW system requires immense computational power, as high-performance machines must solve algorithms.

What Do You Need to Start Mining Cryptocurrency?

The idea of mining cryptocurrency often conjures visions of rooms filled with humming computers. And while that’s one way to do it, getting started as a hobby can be simpler than you think. Here’s what you need:

1. Mining Hardware

Specialized hardware is key to mining efficiency. There are different types of equipment depending on the cryptocurrency:

- CPU Mining (Central Processing Unit): Great for beginners but inefficient for coins like Bitcoin.

- GPU Mining (Graphics Processing Unit): A common choice for Ethereum.

- ASIC Mining (Application-Specific Integrated Circuit): Best for Bitcoin, providing high computational power but at a hefty price.

2. Mining Software

To use that hardware, you’ll need mining software such as CGMiner or NiceHash. This software connects you to the cryptocurrency blockchain and enables you to start solving puzzles.

3. Blockchain Wallet

A wallet is essential for receiving cryptocurrency earnings. Digital wallets like Exodus, MetaMask, or Ledger allow you to store and secure mining rewards.

4. Cheap, Reliable Electricity

Mining is energy-intensive. Having access to low electricity costs or renewable energy is crucial for staying profitable.

Is Cryptocurrency Mining Profitable?

Here’s the million-dollar question, which doesn’t have a simple yes or no answer. Cryptocurrency mining profitability depends on several dynamic factors, such as hardware efficiency, electricity costs, and the cryptocurrency’s market value.

Factors That Impact Mining Profitability

1. Block Rewards and Competition

Most cryptocurrencies have designed their block rewards to decrease over time through “halving.” For example, Bitcoin halves its block reward approximately every four years, tightening supply.

Additionally, mining becomes more competitive as more miners enter the field, which increases the difficulty of puzzles.

2. Cryptocurrency Prices

Mining is most profitable when the cryptocurrency’s price is high. However, market volatility can cause profitability to fluctuate wildly.

3. Electricity Costs

Electricity is the most significant operational expense for miners. Running high-performance mining rigs 24/7 can be prohibitively expensive, depending on your location.

4. Hardware Costs

While powerful mining rigs are crucial, they require a significant upfront investment. Depending on the model, costs can range from a few hundred to tens of thousands of dollars.

5. Mining Pools

Joining a mining pool can increase your chances of earning cryptocurrency. Pool members combine resources to solve puzzles more efficiently and split the rewards. Though you may earn less per block, the steadier income stream is attractive for many miners.

Tools for Calculating Mining Profitability

Before investing in mining equipment, use tools like a cryptocurrency mining calculator to estimate your potential profit. By entering variables like electricity costs, hash rate, and reward rate, you can gauge whether mining will be worthwhile.

Key Cryptocurrencies to Mine in 2024

If you’re considering mining, you might wonder which cryptocurrencies offer the most bang for your buck. Here are a few options for 2024:

1. Bitcoin (BTC)

- Pros: Market leader, precious.

- Cons: Costful ASIC rigs and significant energy usage are required. Highly competitive.

2. Ethereum Classic (ETC)

- Pros: GPU-friendly and popular among hobby miners.

- Cons: Lower value compared to Bitcoin or Ethereum.

3. Monero (XMR)

- Pros: Highly privacy-focused, resistant to ASIC mining.

- Cons: Profit margins can be low depending on energy costs.

4. Litecoin (LTC)

- Pros: Faster transactions than Bitcoin, ASIC-friendly.

- Cons: Slightly less lucrative in recent years.

Environmental Concerns and Ethical Questions

It’s only possible to discuss cryptocurrency mining by touching on its environmental impact. The process, particularly for Bitcoin, consumes enormous amounts of electricity, which has led to criticism about its sustainability.

Alternatives like Proof of Stake (already adopted by Ethereum 2.0) aim to significantly reduce energy consumption, raising questions about how sustainable mining will remain in the long term.

If you’re environmentally conscious, consider mining cryptocurrencies with lower energy footprints or using renewable energy sources for your operations.

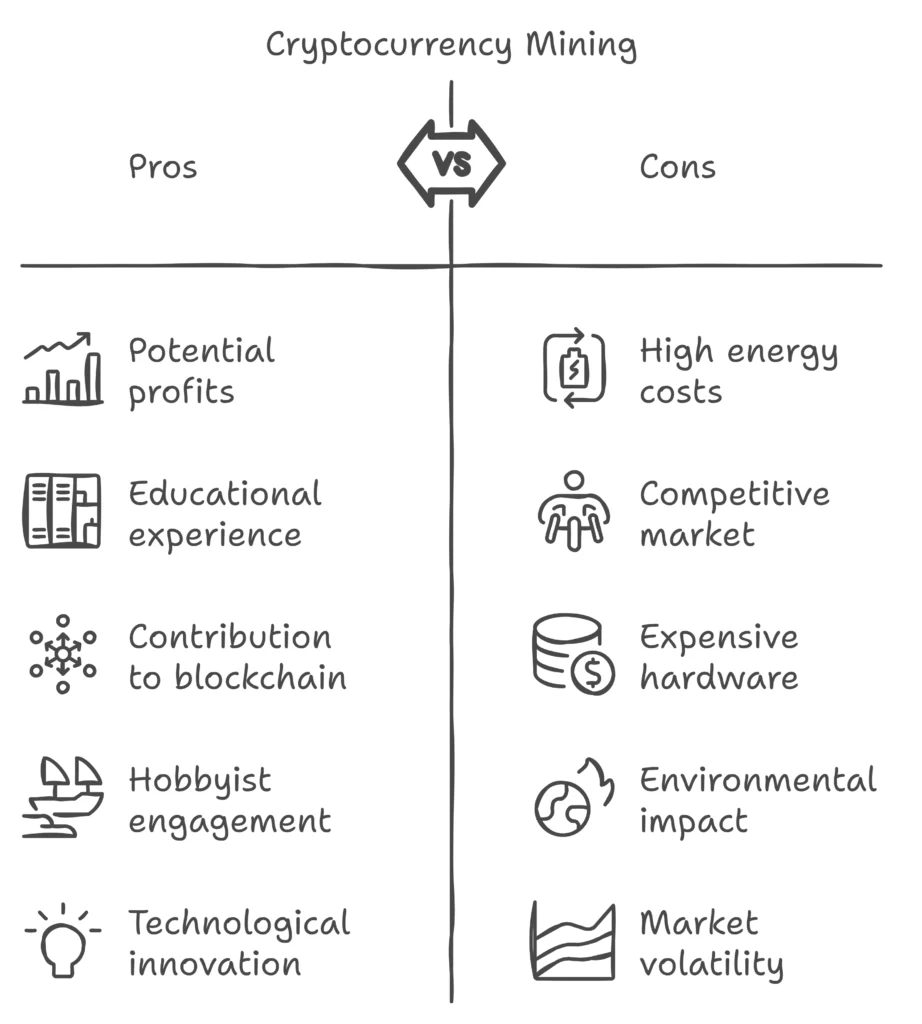

Is Cryptocurrency Mining Worth It For You?

The answer depends on your goals, resources, and level of commitment. Mining can yield decent returns, but for many, it’s about more than money—it’s the thrill of being part of something innovative and technologically advanced.

For hobby miners with access to affordable electricity and equipment, small-scale mining can still be an enjoyable and educational experience. For financial analysts and tech enthusiasts, it’s a great way to better understand blockchain and cryptocurrency.

Alternatives to Mining

If mining doesn’t sound like the right fit for you, you might explore alternatives like:

- Staking cryptocurrencies like Ethereum (ETH).

- Trading cryptocurrencies on an exchange.

- Investing in companies developing blockchain technologies.

Final Thoughts: Making Your Move in Mining

Cryptocurrency mining remains a fascinating, albeit challenging, venture. With high competition, rising energy costs, and evolving technologies, success in mining often depends on strategic planning, efficient operations, and staying ahead of industry trends.

Whether you’re a hobbyist interested in experimentation or a seasoned analyst considering profitability margins, mining offers a unique view into the digital currency landscape.