Since their inception, Bitcoin and other cryptocurrencies have revolutionized the financial landscape and opened up a world of exciting opportunities for investors around the globe. In the same way, the cryptocurrency market observed faster growth that allowed Bitcoin frauds and scams to flourish. It is always crucial for new and introduced traders to understand the risks and follow secure trading habits.

This guide will explain the most common Bitcoin scams in 2024, the red flags to be wary of, and actionable steps to safeguard your cryptocurrency.

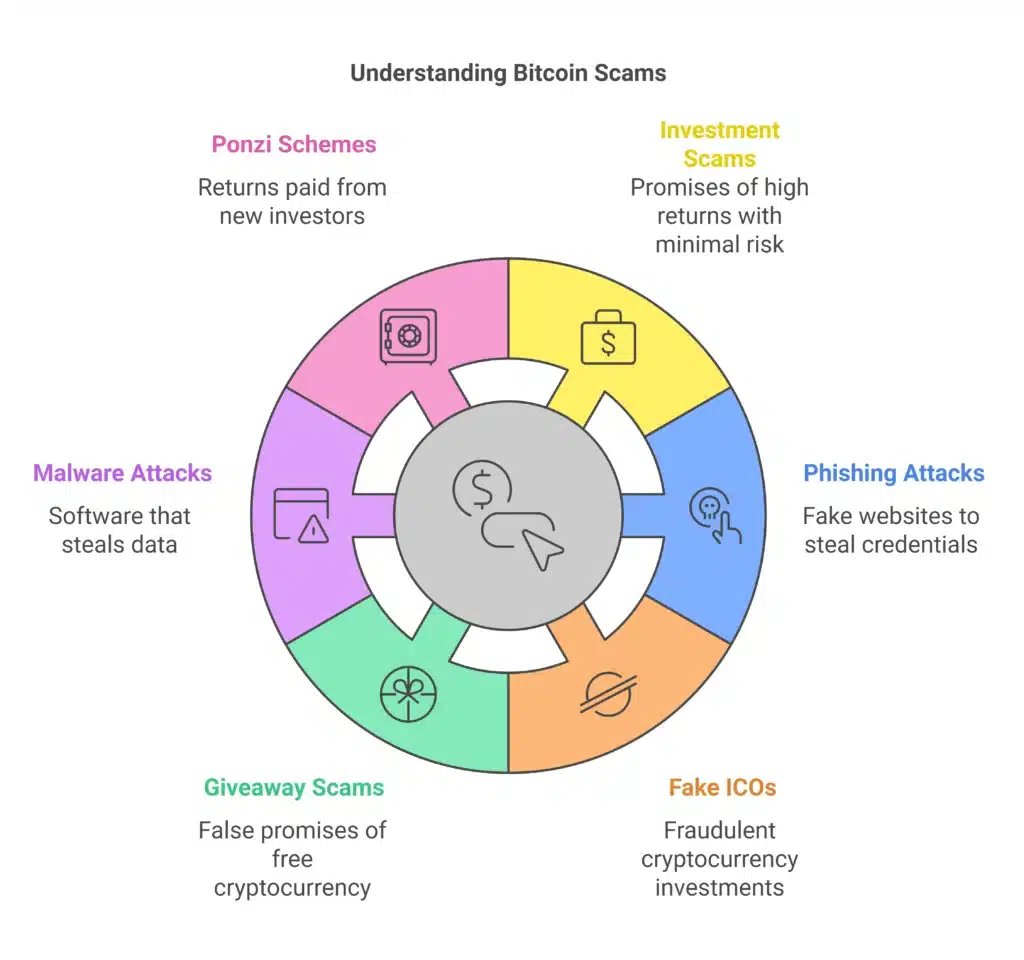

Understanding Bitcoin Scams

Before we discuss prevention strategies, it’s essential to understand how these scams operate. Cryptocurrency transactions are decentralized and irreversible, making them attractive to fraudsters. The lack of regulatory oversight can leave investors vulnerable, but recognizing how scams work is the first step in protecting yourself.

Let’s examine some of the most common Bitcoin scams you’ll likely encounter.

1. Investment Scams

Many Bitcoin scams start with promises of high returns for minimal risk. Scammers use social media platforms, emails, and personal messages to lure victims. They often claim to be experienced investors, traders, or part of a “reliable” investment platform.

Warning Signs of Investment Scams:

- Guarantees of unrealistic profits (e.g., “Earn 100x your investment in a week!”).

- Pressure to act quickly or offers only available for a limited time.

- Requests to transfer Bitcoin or funds to unknown wallets with no accountability.

2. Phishing Attacks

Phishing attacks target your credentials, such as login information or wallets. Scammers create fake exchanges or wallets that mimic legitimate platforms, often encouraging users to input sensitive details.

How Phishing Attacks Work:

- Fake websites or emails claim to offer deals or require “verification.”

- Victims click malicious links, exposing their information to scammers.

3. Fake Initial Coin Offerings (ICOs)

Fraudsters sometimes advertise “upcoming” cryptocurrencies through fake ICOs, touting them as the next Bitcoin or Ethereum. They convince users to invest early, only to disappear with the funds.

Red Flags:

- A lack of white papers or vague project details.

- There is no transparent information about the development Team or roadmap.

- It’s over-the-top social hype with no legitimate media coverage.

4. Giveaway Scams

You might have seen tweets or YouTube videos claiming, “Send 0.5 BTC to this address, and we’ll send you 1 BTC in return.” These are classic giveaway scams, often featuring fake celebrity endorsements.

How to Spot Fake Giveaways:

- Promises of “free money.”

- Accounts impersonating influential people or brands.

- Suspicious payment addresses with no transaction transparency.

5. Malware Attacks

Once installed, malware embedded in seemingly innocuous software can steal personal data, wallets, or private keys. Cryptocurrency scams often involve downloading fake wallet software or plugins that seem official.

Common Delivery Methods:

- Pop-up ads encouraging immediate downloads for a wallet upgrade.

- Fake mobile apps are masquerading as legitimate ones on app stores.

6. Ponzi and Pyramid Schemes

Ponzi schemes entice investors by using funds from new participants to pay earlier ones. These scams promise guaranteed returns but eventually collapse once new contributors dry up.

Red Flags with Ponzi Schemes:

- Recruitment-focused investment opportunities.

- Promoters have no clear income source other than to attract new members.

- Complex or opaque investment models.

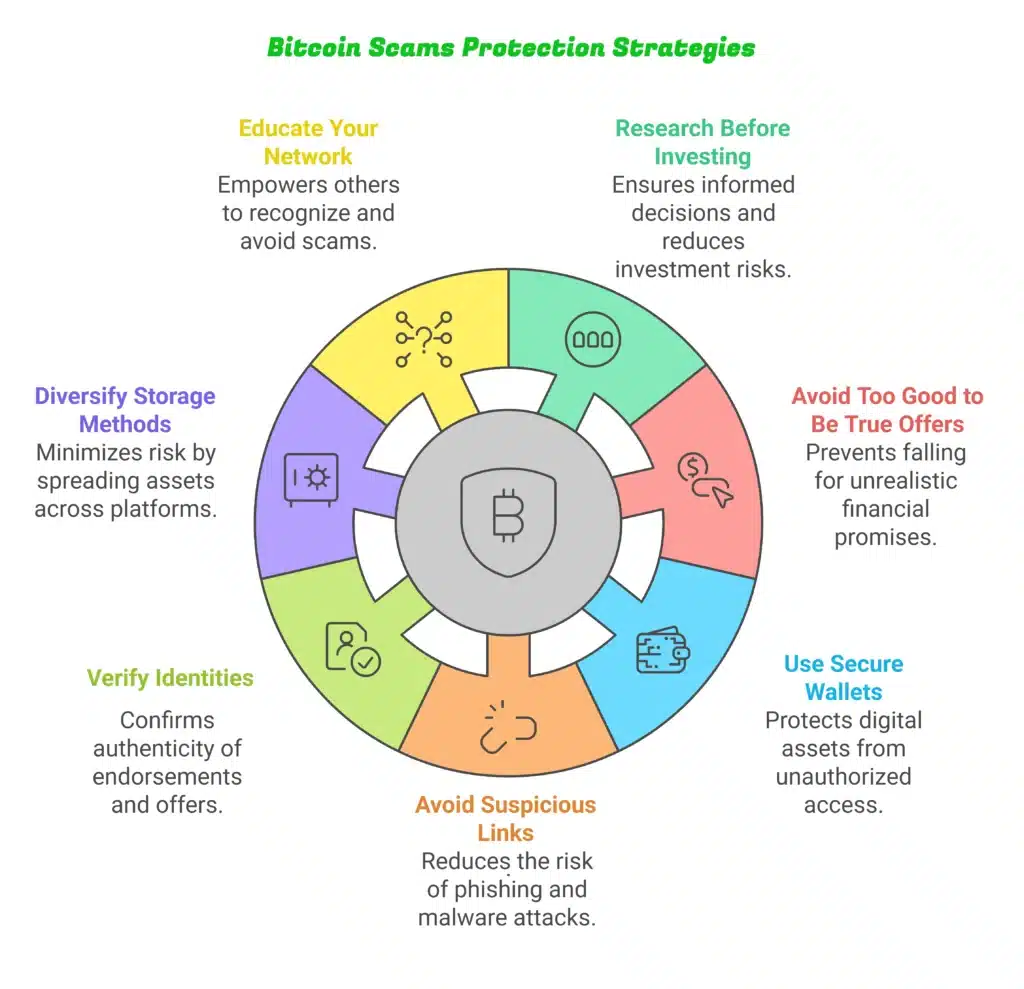

How to Protect Bitcoin Scams

Now that you’re familiar with common scams, the key lies in prevention. Here are actionable steps to stay safe while trading and investing in Bitcoin.

1. Research Before Investing

Always verify the legitimacy of exchanges, wallets, or investment platforms. Stick to well-known names in the industry, such as Coinbase, Kraken, or Binance. Before investing in a new cryptocurrency project, check for:

- A detailed white paper that explains the project’s purpose.

- Transparency about the development Team and partnerships.

- Verified user reviews and media coverage.

2. Don’t Fall for “Too Good to Be True” Promises

If an offer sounds too good to be true, it probably is. Avoid schemes that promise exorbitant returns, particularly from strangers or unsolicited messages. Cryptocurrency investments inherently involve risk, and no one can guarantee sky-high returns.

3. Use Secure Wallets

Always store your Bitcoin and other cryptocurrencies in secure wallets. Hardware wallets (like Ledger or Trezor) are considered the safest option because they store your private keys offline. For those using digital wallets, make sure they are:

- From a trusted source.

- Enabled with two-factor authentication (2FA) for added security.

4. Avoid Clicking Suspicious Links

Never click on links from unknown sources or unsolicited emails. Bookmark legitimate cryptocurrency exchange websites and avoid accessing them from links found in ads. Often, small URL changes in fake websites are designed to trick you.

5. Verify Identities and Social Media Accounts

Check the legitimacy of “celebrity endorsements” or offers on social media. Many scammers clone well-known accounts with minor changes to the handle or display name. Always cross-check before proceeding.

6. Diversify Your Storage Methods

Split your holdings across multiple wallets or exchanges to minimize risk. When part of your funds is stored offline, this strategy is called “cold storage.” If one account gets compromised, the damage will be limited.

7. Educate Your Network

Share awareness of scams with your friends, family, and online communities. Fraudsters thrive on uneducated victims, and by spreading the word, you can help create a safer trading space for everyone involved.

What to Do If You’re a Victim of a Bitcoin Scam

If you’ve fallen victim to a Bitcoin scam, act quickly.

- Report It: Inform your local authorities and file a report with fraud detection organizations like Action Fraud or the Anti-Phishing Working Group.

- Protect Remaining Assets: Immediately move your remaining funds to a safe wallet to avoid further theft.

- Spread Awareness: Sharing your story can help others avoid similar scams.

Bitcoin Security in 2024 and Beyond

With the cryptocurrency market growing, scams are likely to evolve alongside it. However, by learning about common Bitcoin scams in 2024 and practising safe crypto trading habits, you can enjoy the many benefits of digital currencies while minimizing risks.

Stay diligent, informed, and cautious in every Bitcoin transaction. Protecting your investments is as important as growing them.

Explore our free resources and community discussions for more tips and tools to enhance cryptocurrency security. Safe trading starts with knowledge!