The cryptocurrency world offers exciting investment opportunities, but where there’s money, scams are never far behind. Scammers are constantly inventing new ways to defraud crypto investors, leaving many questioning how best to protect their assets in 2024.

From fake investment schemes to phishing attacks, crypto scams aren’t just persistent—they’re increasingly sophisticated. But don’t worry. With the right knowledge and tools, you can recognize red flags and safeguard your investments.

This guide dives into the most common cryptocurrency scams in 2024, how they operate, and, most importantly, how to avoid falling victim.

The Rise of Cryptocurrency Scams

Cryptocurrency scams have been a growing concern since Bitcoin gained mainstream attention over a decade ago. According to Chainalysis, scammers stole $5.9 billion worth of crypto globally in 2022—a number that continues to rise as crypto adoption grows. While decentralized technology offers benefits like security and transparency, this same innovation is often exploited by bad actors.

Scammers leverage excitement, technical confusion, and a lack of regulation to target unsuspecting and sometimes savvy investors. The good news is that understanding the tactics scammers use is your first line of defense.

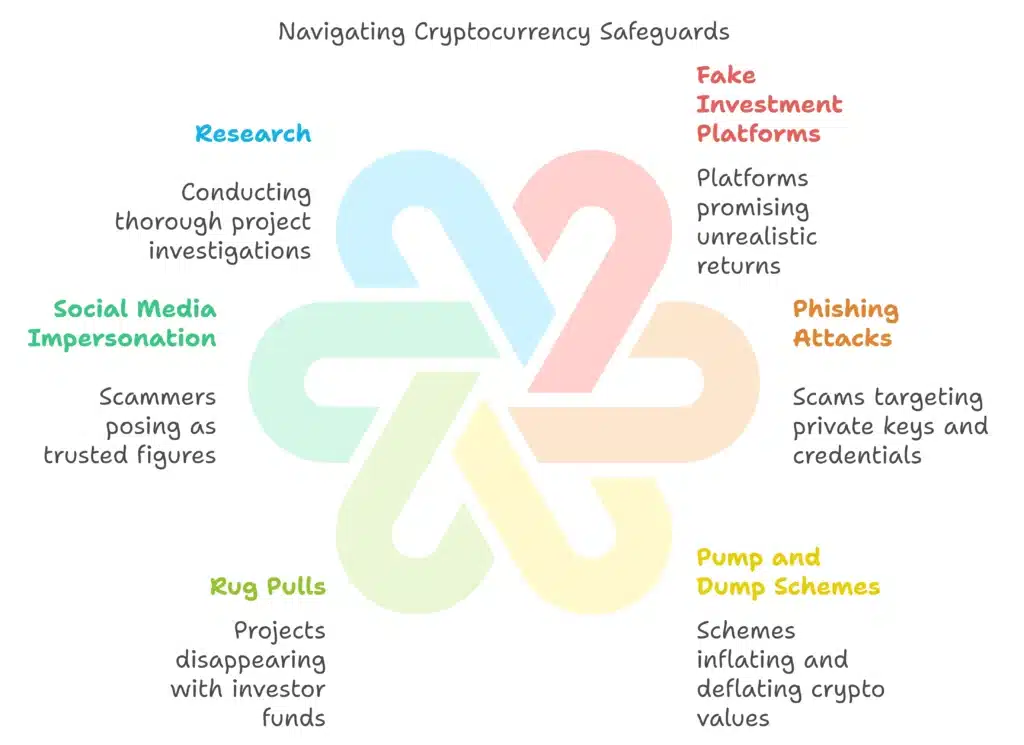

Common Cryptocurrency Scams to Watch for

1. Fake Investment Platforms

Many scammers promise huge returns through sham investment platforms. They lure investors in with glossy websites, fake testimonials, and promises of impossibly high profits. Victims often lose their crypto the moment they transfer it to the platform.

- Promises of “guaranteed” returns.

- Platforms with no verifiable history or community presence.

- Pressure to act quickly with phrases like “limited-time offer.”

2. Phishing Attacks

Phishing scams target your private keys, seed phrases, or account credentials. Scammers use fake websites or emails that mimic legitimate crypto platforms, tricking you into handing over sensitive information.

- Emails or messages requesting your wallet credentials.

- Misspelled URLs designed to look like legitimate crypto platforms.

- Pop-ups claiming your wallet is compromised and urging you to “verify” immediately.

3. Pump and Dump Schemes

“Pump and dump” schemes involve scammers artificially inflating the value of a cryptocurrency to encourage investors to buy. Once the price peaks, scammers sell off their assets, causing the value to plummet and leaving investors with worthless coins.

- Unverified influencers hyping obscure tokens.

- Exaggerated claims about a token’s future value.

- Sudden, unexplained price surges followed by rapid drops.

4. Rug Pulls

Rug pulls happen when the developers behind a DeFi project or cryptocurrency vanish with investors’ funds. These scams often involve projects that seem legitimate on the surface but lack any real product or roadmap.

- Tokens that lack liquidity or have anonymous development teams.

- Promises of “too good to be true” returns via new projects.

- No visible activity or roadmap on GitHub or other public channels.

5. Social Media Impersonation Scams

Scammers often pose as trusted figures in the crypto world—such as well-known founders, influencers, or brands. They send messages promoting giveaways or airdrops, asking investors to send crypto in exchange for larger rewards.

- Messages from accounts that slightly misspell the names of real individuals or companies.

- “Free giveaways” requiring you to send small deposits first.

- Urgent messaging like “Act fast before this opportunity expires!”

How to Stay Safe from Crypto Scams

1. Do Thorough Research

Spend time understanding the projects or platforms you want to engage with. Check for legitimacy by reviewing the whitepaper, exploring GitHub repositories, and ensuring transparency from developers.

Tips:

- Look for credible third-party reviews.

- Avoid projects with anonymous teams.

- Verify social handles and websites.

2. Use Secure Wallet Practices

Your wallet and private keys are your gateway to crypto. Protect them as you would your bank account credentials.

Tips:

- Use hardware wallets for long-term storage.

- Never share your seed phrase or private keys with anyone.

- Enable multi-factor authentication for your accounts.

3. Stick to Reputable Exchanges and Platforms

When buying or trading cryptocurrency, ensure you use only well-established, regulated exchanges. New platforms may offer enticing features but often come without guarantees of security.

Tips:

- Favor platforms compliant with local regulations.

- Check for exchanges with a proven track record of handling user complaints.

- Monitor for frequent platform updates and audits.

4. Stay Skeptical of Unrealistic Promises

Scams often prey on our desire for high returns—but in crypto, if it sounds too good to be true, it probably is.

Tips:

- Ignore promises of guaranteed returns.

- Research influencers endorsing a token before trusting their claims.

- Verify claims through independent data sources, like CoinMarketCap or CoinGecko.

5. Double-Check All Communication

Scammers target victims through impersonation. Always verify communications from companies or individuals in the crypto space.

Tips:

- Verify social media accounts by checking for blue verification badges.

- Check the sender’s email address carefully for slight alterations.

- Avoid responding to unsolicited messages offering investment opportunities.

6. Join Trusted Crypto Communities

Forums and communities like Reddit’s r/cryptocurrency and Telegram groups often share insights about legitimate projects while warning about potential scams.

Tips:

- Engage in conversations with knowledgeable investors.

- Use these spaces to gather opinions before investing.

- Cross-check recommendations with other reliable sources.

What to Do If You’re Scammed

Despite taking precautions, even the savviest investors sometimes fall victim. If this happens, act quickly.

Report the Scam

- Notify the platform where you were scammed (such as your exchange or wallet provider).

- Report the scam to local authorities and international anti-cybercrime agencies.

Warn Others

Scammers rely on ignorance. By sharing your experience in forums or crypto communities, you can help others avoid similar traps.

Strengthen Your Defenses

- Audit your remaining wallets for vulnerabilities.

- Evaluate your crypto investments and remove assets from less-secure platforms.

The Final Word

Staying one step ahead of cryptocurrency scammers in 2024 requires vigilance, education, and the right practices. Scams are only successful when they find uninformed or distracted targets—familiarizing yourself with how they work is the first step toward protecting your investments.

Remember, no investment in cryptocurrency comes without risk. But with the strategies outlined above, you can participate in this exciting financial frontier more confidently.

By taking proactive steps, you remain in control, ensuring your crypto profits are yours to keep. Safe investing!