Bitcoin has become incredibly popular lately, and it’s no surprise that so many are interested in learning how to invest safely in this digital currency. But if you’re new to cryptocurrency, it can feel overwhelming—like stepping into entirely unfamiliar territory. If you’re new to Bitcoin, you might feel overwhelmed with questions like, “Where do I even start?” or “How can I make sure my investment is secure?”

Don’t worry—we’ve got you covered. This guide will walk you through how to buy Bitcoin safely for beginners in the USA, covering everything you need to know to make secure and informed decisions.

What is Bitcoin and Why Should You Invest in It?

Bitcoin is a digital currency that operates on a technology called blockchain. Unlike traditional money issued by governments, Bitcoin is decentralized, meaning any central authority does not control it. This makes Bitcoin appealing to many as a hedge against inflation and a high-potential long-term investment.

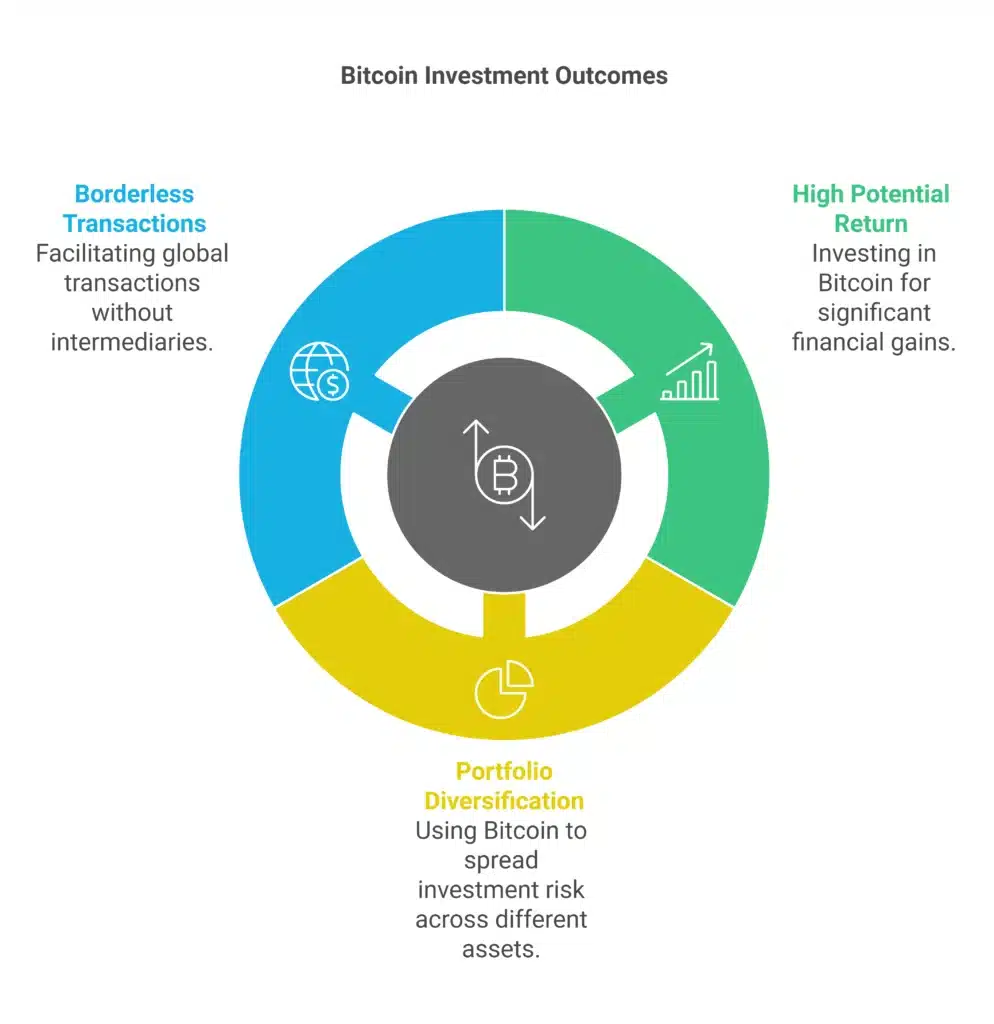

Some reasons people invest in Bitcoin include:

- High Potential Return: Bitcoin has grown significantly over the years, earning attention as an exciting option for investors who don’t mind taking on a bit of risk.

- Portfolio Diversification: Cryptocurrency can diversify your investment portfolio.

- Borderless Transactions: Bitcoin allows for seamless global transactions without intermediaries.

Like any investment, Bitcoin comes with its risks. But learning how to enter the market wisely can help you protect your money and increase your chances of seeing a return.

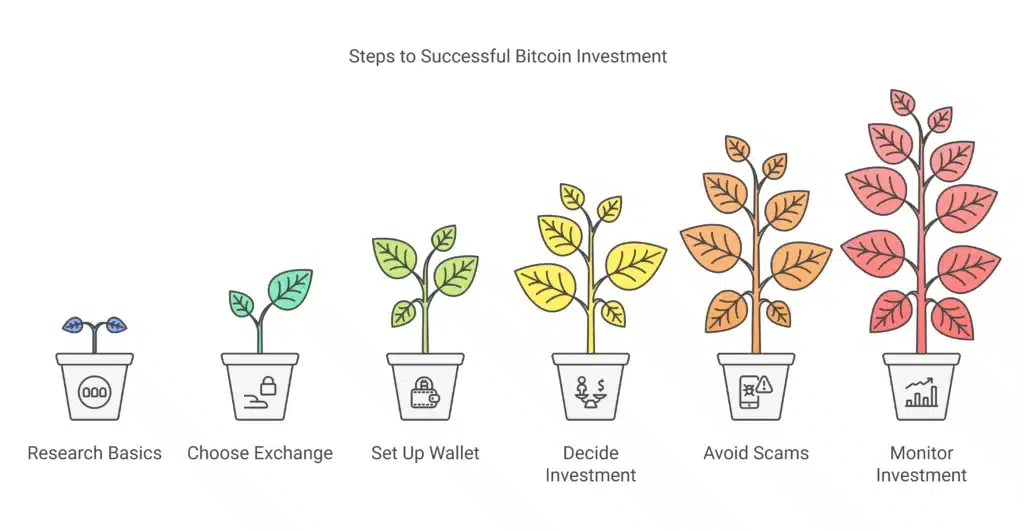

Step 1: Research Bitcoin Basics

Before you invest, take the time to understand how Bitcoin works and what you’re getting into. You don’t need to be a tech wizard, but knowing the basics will help you make smarter decisions.

Key Terms to Know:

- Blockchain: A digital ledger that records Bitcoin transactions.

- Wallet: A secure app or hardware device where your Bitcoin is stored.

- Exchange: A platform where you can buy, sell, or trade Bitcoin.

Why this matters:

By understanding these fundamentals, you’ll avoid common pitfalls and scams that prey on uninformed investors. For example, knowing how wallets work can protect you from losing your Bitcoin to theft.

Step 2: Choose a Trusted Cryptocurrency Exchange

When you’re ready to jump into Bitcoin, the first step is finding a reliable cryptocurrency exchange. It’s like an online marketplace where you can quickly and safely buy or sell Bitcoin.

Top Trusted Exchanges for Beginners in the USA:

- Coinbase (Highly User-Friendly): Ideal for first-time buyers due to its intuitive design and educational tools.

- Kraken (For Advanced Security): Known for its excellent security protocols.

- Gemini (Regulated in the USA): Offers peace of mind with its regulatory compliance.

- Binance.US (Great for Low Fees): Offers competitive transaction fees for users.

Tip: Look for exchanges with a solid reputation, transparent pricing, and robust security measures (two-factor authentication, encryption, etc.). Always read reviews and verify their legitimacy before signing up.

Keyword Integration: To minimize risks, select an exchange that allows you to “safely buy Bitcoin.”

Step 3: Set Up a Bitcoin Wallet

Once you’ve purchased Bitcoin, you’ll need a safe place to store it. While some exchanges offer built-in wallets, keeping your Bitcoin in a private wallet gives you more control and security.

Types of Bitcoin Wallets:

Hot Wallets (Online):

- Examples: Coinbase Wallet, Exodus, Mycelium.

- Pros: Convenient and accessible from anywhere.

- Cons: Vulnerable to hacking if not appropriately secured.

Cold Wallets (Offline):

- Examples: Ledger Nano X, Trezor.

- Pros: Offers superior security because it’s disconnected from the internet.

- Cons: Less convenient for everyday transactions.

Security Tip:

- Always enable two-factor authentication (2FA) on your wallet to add an extra layer of security.

- Make backup copies of your wallet recovery phrases and store them securely.

Step 4: Know How Much to Invest

Deciding how much Bitcoin to buy? Start with an amount you’re okay risking. Bitcoin’s value can rise and fall quickly—sometimes in just a few hours—so it’s best to only invest what you’re comfortable losing.

Pro Tips for Beginners:

- Start Small: Begin with $50–$100 to get familiar with the process.

- Use Dollar-Cost Averaging (DCA): Instead of buying Bitcoin all at once, invest small amounts regularly to reduce the impact of market volatility.

By starting modestly, you can test the waters without risking significant losses.

Step 5: Protect Yourself From Scams

Unfortunately, the cryptocurrency world is rife with scams targeting beginners. Learning to identify red flags will keep your investment safe.

Common Scams to Avoid:

- Phishing Websites: Fake websites that mimic exchanges or wallets to steal credentials.

- Too-Good-To-Be-True Offers: Avoid “guaranteed returns” or unsolicited investment opportunities—even from family or friends.

- Imposter Experts: Beware of social media messages from fake influencers claiming to be crypto pros.

Keyword Integration: Safely buying Bitcoin involves spotting scams before they impact you.

Security Checklist:

- Verify URLs before entering sensitive information.

- Never share your private key or recovery phrase with anyone.

- Double-check all transactions before confirming.

Trust is good, but verification is essential in the crypto space.

Step 6: Monitor Your Investment

Once you’ve bought and securely stored your Bitcoin, you’ll want to monitor its performance. Tracking tools like Blockfolio or CoinMarketCap can help you monitor Bitcoin prices and trends.

When to Buy or Sell?

For Long-Term Investors:

- Hold your Bitcoin and wait for potential long-term appreciation.

For Short-Term Traders:

- Follow the market closely and use stop-loss orders to reduce losses.

Advice for Beginners:

Always stick to your investment plan and avoid making emotional decisions based on market volatility.

Are You Ready to Start Your Bitcoin Journey?

Getting started with Bitcoin doesn’t have to be overwhelming. By following these six steps, you’ll be well on your way to starting your cryptocurrency investing journey safely and confidently. Just remember—the key is to do your research, set up securely, and take it slow.

Here’s one final tip—don’t go it alone! Join trusted communities, keep up with reputable crypto news sources, and stay informed as you grow as an investor.

If you’re ready to take the leap into Bitcoin, check out reliable platforms like Coinbase or Kraken to get started. Before you know it, you’ll feel right at home navigating the exciting world of cryptocurrency!