Bitcoin is no longer simply a buzzword in the financial world — it is a tool for financial independence and wealth generation. As its popularity continues to rise in the United States more investors are looking at how Bitcoin can work for them beyond buying and holding. One particularly interesting strategy is generating passive income.

Passive income means money earned without day-to-day effort. Coupled with the potential for Bitcoin to reach new all-time highs, it provides a way for investors to earn passive income without having to trade or watch the markets daily. But how does it all work? If you’re a seasoned crypto investor or a young professional curious to explore digital assets, this guide will walk you through how to earn passive income with Bitcoin.

Understanding Bitcoin and Passive Income

Before we explain how to earn passive income from Bitcoin, we must understand the basics. Bitcoin is a type of cryptocurrency powered by blockchain technology. A blockchain is a decentralized ledger that records all transactions securely and transparently, making Bitcoin a trustless and verifiable digital currency.

How can Bitcoin generate passive income?

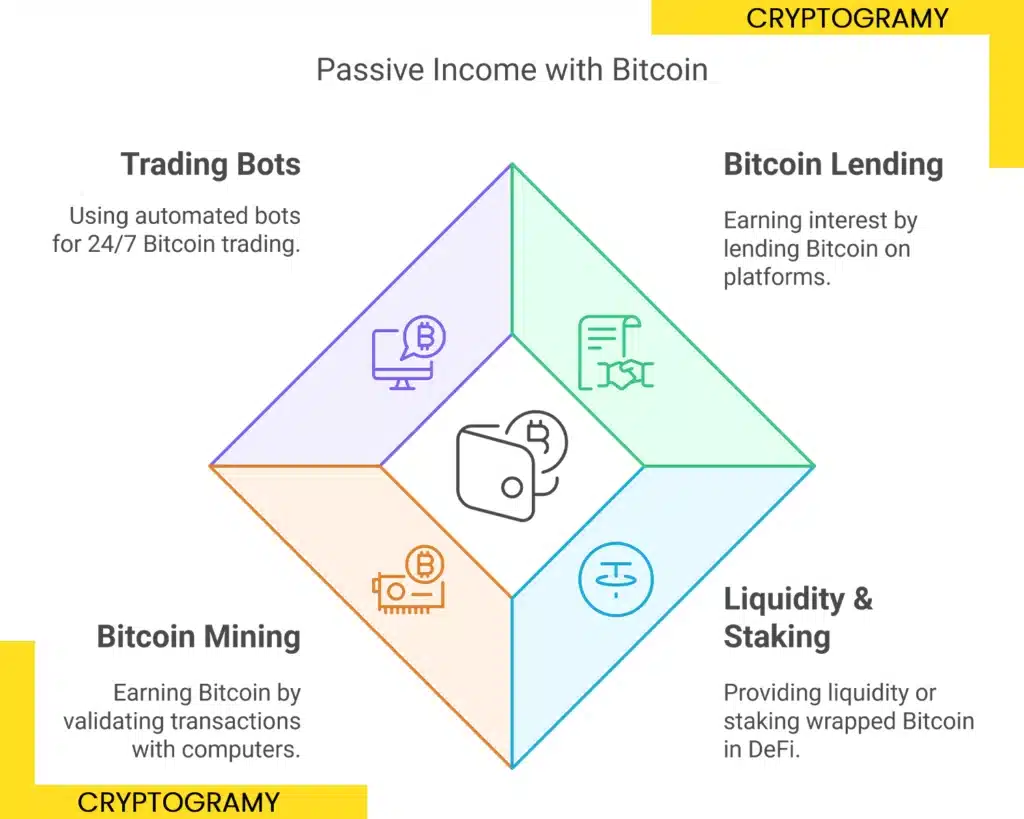

Unlike traditional investments such as dividend-paying stocks, Bitcoin offers different ways to generate passive income. Here are the most popular methods:

- Staking: While not directly available for Bitcoin (as Bitcoin doesn’t use a Proof-of-Stake model), users can stake-wrapped versions like WBTC or participate in liquidity pools.

- Lending: Loan your Bitcoin to earn interest.

- Mining: Use computers to solve complex algorithms and get rewarded in Bitcoin.

- Trading Bots: Automate your trading strategies with minimal manual intervention.

Each strategy involves a different level of effort, risk, and reward, which we’ll explore in detail later.

Legal and Tax Implications in the US

Navigating Bitcoin in the United States requires regulatory and tax considerations. The US government views Bitcoin as property, meaning certain transactions—like earning passive income—are subject to taxation. Here’s what you need to know:

- Taxes on Passive Income: Any gains from lending, staking rewards, or even mining are taxable as income.

- Capital Gains: Selling or converting Bitcoin into fiat currency (USD) may incur capital gains tax.

- Regulations: Although the US is relatively accommodating to Bitcoin, regulations can vary by state, so staying updated on local laws is essential.

To avoid surprises, consult a tax professional who understands cryptocurrency to ensure compliance.

Strategies to Earn Passive Income with Bitcoin

Now, onto the good stuff. These are four ways you can start earning passive income with Bitcoin:

1. Bitcoin Lending

Lending platforms allow you to loan Bitcoin to other users or institutions in exchange for interest. Platforms like BlockFi, Celsius, and Nexo simplify this process for investors.

Pros:

- Predictable income stream through fixed interest rates.

- Little effort is needed once the loan is set up.

Cons:

- Risk of platform default or hacks.

- Your Bitcoin is locked for a set period.

Potential Returns: 4%-10% annually, depending on the platform and market conditions.

2. Liquidity Provision & Staking

Staking typically applies to Proof-of-Stake cryptocurrencies, but Bitcoin holders can stake wrapped versions (such as WBTC) on decentralized finance (DeFi) platforms. Alternatively, you can provide liquidity to decentralized exchanges (DEXs) such as Uniswap.

Pros:

- High potential returns in DeFi liquidity pools.

- Easy to diversify across multiple protocols.

Cons:

- High technical knowledge is required.

- Risk of impermanent loss in liquidity pools.

Potential Returns: 5%-20% annually, depending on the platform and risks.

3. Bitcoin Mining

Mining is the traditional way of earning Bitcoin. Miners validate transactions and secure the Bitcoin network by using high-powered computers to solve mathematical equations.

Pros:

- Directly earns Bitcoin without needing intermediaries.

- Can scale with reinvestment into mining equipment.

Cons:

- Extremely energy-intensive.

- High upfront costs for equipment and maintenance.

Potential Returns: Variable, depending on energy costs, Bitcoin prices, and mining difficulty.

4. Automated Trading Bots

Automated bots execute trading strategies for you, taking advantage of market opportunities 24/7 without manual input. Services like 3Commas and Cryptohopper are widely used.

Pros:

- There is no need to monitor trades constantly.

- Customizable trading strategies to suit your goals.

Cons:

- Risks of poorly functioning algorithms.

- Success hinges on robust market data and configuration.

Potential Returns: Highly variable, depending on strategy and market conditions.

Best Practices and Tips

To maximize your passive income while minimizing risk, follow these best practices:

- Research Platforms Thoroughly: Not all platforms are created equal. Opt for reputable services with strong security measures in place.

- Diversify Your Income Streams: Spread your Bitcoin across multiple strategies (e.g., lending and staking) to reduce risk.

- Understand the Risks: DeFi platforms can be risky, while mining profits are tied to energy costs and Bitcoin prices. Don’t invest more than you’re willing to lose.

- Keep Up With Regulations: Stay informed about changes in crypto laws and tax implications.

- Start Small: If you’re new to any of these strategies, it’s wise to begin with small amounts before fully committing.

Real-Life Examples and Lessons

To inspire your path, here are two real-life examples of individuals who’ve earned passive income through Bitcoin:

- Emma, 32, New York City: Emma started by lending her Bitcoin on BlockFi, earning 6% interest annually. Over two years, she reinvested her returns, allowing her portfolio to grow steadily without additional Bitcoin purchases.

- Jack, 28, San Diego: Jack invested in mining equipment early on. While he faced high setup costs, Bitcoin’s price surge allowed him to recoup his investment within a year. Now, his operation generates a consistent profit.

Takeaway? Strategies like lending are lower risk and more straightforward to start, while mining offers significant potential for long-term gains if you can afford the upfront investment.

Start Your Passive Income Journey Today

Making passive income with bitcoin is indeed doable and easy using the tools and strategies available. Whether you’re a conservative investor or an adventurous risk-taker, there’s a method for everyone, from lending platforms to mining setups.

So, get started by researching the type of platforms that are available to your particular kind of goal, setting achievable goals for yourself and making sure you attend to the trends of crypto on a daily basis. By getting Bitcoin right, you can direct your efforts towards other aspects of your financial life.

So are you ready to begin your crypto passive income journey? Search “Passive Income Bitcoin” on your preferred lending or trading site and grow your $$$!