Bitcoin is no longer a buzzword — it’s a financial revolution. In just over a decade, cryptocurrency has evolved from a niche investment concept to a mainstream financial instrument. Bitcoin has sparkled to become the flagship cryptocurrency, and with many US residents buying, holding, and now wanting to convert their digital assets into pure cash. Whether you wish to unlock those profits or are just in need of some liquidity, this guide covers everything you need to know about transferring from Bitcoin to cash in a timely and safe manner.

Understanding Bitcoin and the Cash Transfer Process

Before we dive into the steps, we should briefly understand what Bitcoin is and how the transfer works.

Bitcoin is a peer-to-peer spinoff of a blockchain technology. Blockchain is the digital ledger that records all transactions on the network of Bitcoin, providing transparency and security. Banks typically have the control over conventional money, however, with Bitcoin, it is peer-to-peer which loosens centralized control.

When you convert Bitcoin into cash, however, it essentially means you exchanged your cryptocurrency possessions for US dollars or from another fiat currency. The conversion is done using a cryptocurrency exchange or broker. The result? USD goes into your bank account or into your hand.

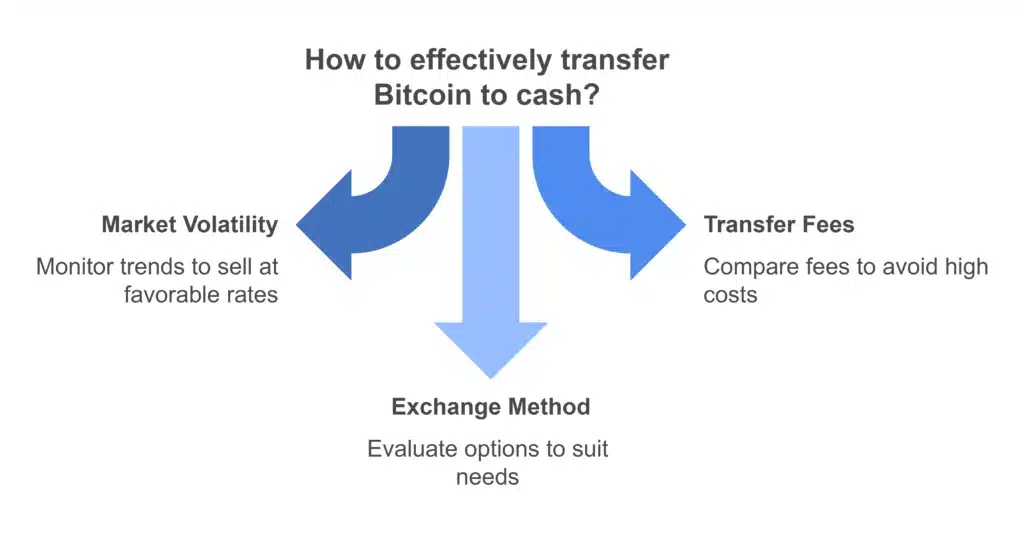

Factors to Consider Before Transferring Bitcoin to Cash

If you’re ready to cash in your Bitcoin, there are some crucial factors to keep in mind:

- Market Volatility

Bitcoin’s price can fluctuate dramatically. Monitor market trends to ensure you sell your coins at a favorable rate.

- Transfer Fees

Different platforms charge varying transaction fees and withdrawal fees. Compare these costs to avoid paying unnecessarily high fees.

- Exchange Method

There are multiple ways to cash out Bitcoin. Each method comes with its benefits, risks, and limitations. Evaluating these options ensures you choose the one that best suits your needs.

By keeping these factors in mind, you can avoid common pitfalls and maximize the value of your Bitcoin.

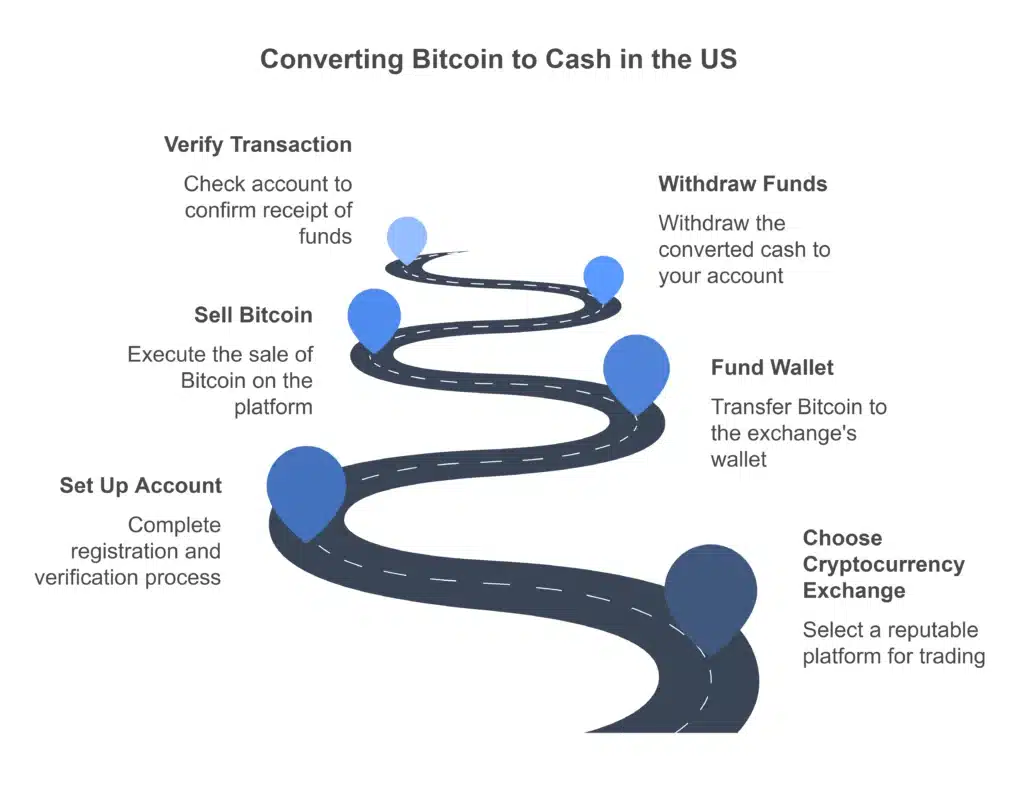

Step-by-Step Guide to Transfer Bitcoin to Cash in the US

Now that you understand the basics, here’s a detailed guide to help you convert Bitcoin to cash efficiently:

Step 1: Choose a Reputable Cryptocurrency Exchange

Platforms like Coinbase, Kraken, and Binance.US are popular and reliable cryptocurrency exchanges in the United States. These exchanges allow you to sell Bitcoin and withdraw dollars. Compare their fees, processing times, and user reviews to choose one that aligns with your needs.

Step 2: Set Up Your Account

Sign up on your chosen exchange platform and complete the verification process (this could include ID verification, proof of address, etc.). Account verification is crucial for security and compliance with regulatory requirements.

Step 3: Fund Your Wallet

Transfer your Bitcoin from your wallet to the exchange’s wallet. Most platforms will have a simple process for transferring Bitcoin using a unique wallet address tied to your account.

Step 4: Sell Your Bitcoin

Navigate to the “Sell” section on the platform, specify the amount of Bitcoin you want to sell, and complete the trade. Some platforms even allow you to set a specific price you wish to sell through a limit order.

Step 5: Withdraw Your Funds

Once you’ve sold your Bitcoin, the USD (or the fiat currency you’ve selected) will appear in your account. Select your preferred withdrawal method—bank transfer, PayPal, or physical cash where available—and confirm the transaction.

Step 6: Check Your Bank or Payment Account

Finally, monitor your bank account or payment method to ensure the funds land safely. Depending on the withdrawal method, this could take a few hours to a few business days.

Alternatives to Direct Bitcoin-to-Cash Transfer

If you’re not ready to liquidate your Bitcoin to USD directly, here are some alternative options:

1. Use Bitcoin to Buy Goods and Services

Some retailers and service providers accept Bitcoin as payment. Platforms like Overstock and coffee shops allow you to spend Bitcoin directly.

2. Bitcoin ATMs

Bitcoin ATMs provide a straightforward way to convert Bitcoin to cash in person. Scan your wallet QR code, select the amount to withdraw, and collect your cash. Note that Bitcoin ATMs often charge higher fees.

3. Peer-to-Peer (P2P) Transactions

Join P2P platforms like LocalBitcoins or Paxful to sell your Bitcoin directly to another individual. These platforms facilitate the transaction while ensuring the buyer and seller meet their obligations.

Best Practices and Tips for Smooth Transfers

Cashing out Bitcoin doesn’t have to be stressful. Follow these best practices to keep your transfers secure and efficient:

- Prioritize Security

Always enable two-factor authentication on exchange platforms, and never share sensitive information with anyone.

- Understand Tax Implications

Converting Bitcoin to cash is considered a taxable event in the US. Keep accurate records of transactions to comply with IRS requirements.

- Choose Low-Fee Options

Compare fees across platforms to avoid overpaying. Some exchanges offer discounts on transaction fees for high-volume traders or if you use their native tokens.

- Be Patient

Timing is key. Monitor Bitcoin market prices and convert your holdings during a favorable market window to get the best value.

Wrapping Up: Convert Bitcoin to Cash With Confidence

“How to gracefully convert Bitcoin to cash? Well, this all comes to having the right tools and strategies. The method you choose to buy varies on your goals and preferences when it comes to a cryptocurrency exchange, a Bitcoin ATM, or people in peer-to-peer transactions.

With Bitcoin adoption becoming more widespread in the US, it is critical to learn how to properly and strategically manage your crypto assets. With this guide, you are set to make informed decisions, reduce risks and reap the benefits of the crypto-to-cash curve.

Ready to start withdrawing some cash from your Bitcoin? Don’t wait, start today, search for a site that makes it easier for US residents.