Cryptocurrencies have rocked the financial world, with offerings promising (or threatening) eye-popping gains and groundbreaking technology. But for both seasoned investors and newcomers, one question looms large — why are cryptocurrency prices so volatile? Comprehending cryptocurrency price volatility is essential to make better investment decisions and tackle the fluctuations of this market.

This blog goes on to explore the drivers of crypto volatility, how to measure it and how to manage its risk. If you’re into cryptocurrency or are an investor, this guide will clarify this confusing topic.

What Is Crypto Volatility?

‘Volatility’ is the sudden and random fluctuations of an asset’s price within a short time. In this case, price volatility refers to the extreme price swings that can sometimes happen in the cryptocurrency world, including small bumps to serious spikes or dips in the price in a matter of moments. Indeed, Bitcoin—the biggest of all the cryptocurrencies, and the most stable—price has been known to move thousands of dollars even in a single trading day.

If volatility exists in more traditional assets such as stocks or commodities, cryptocurrencies are well-known for their sudden swings. But why?

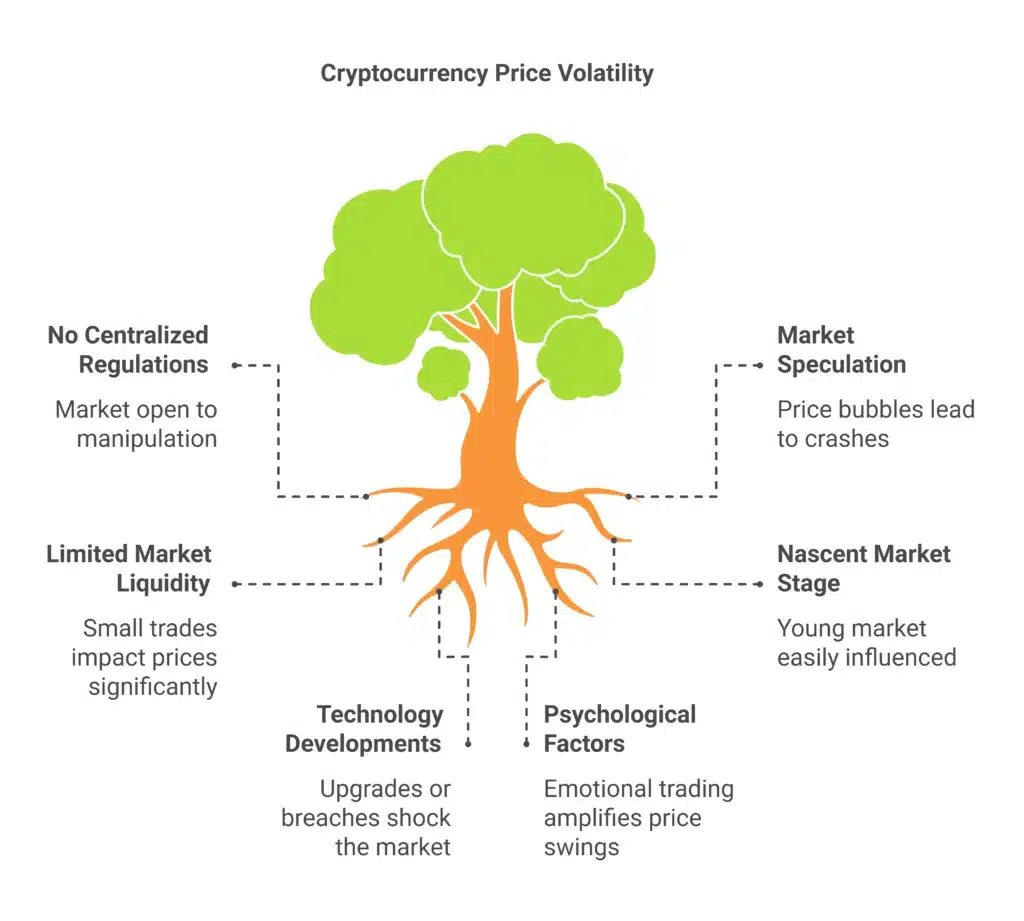

Why Are Cryptocurrency Prices So Volatile?

There are a few reasons behind the wild swings that cryptocurrency markets experience. Here are some of the most important reasons among them.

No Centralized Regulations

Common financial systems are regulated by central authority such as government or bank, where as crypto is a decentralized system that function independently from any central authority. Without such tight regulation, there are fewer safety nets in place, leaving the market open to manipulation and crazy behavior from traders.

As an example, one tweet from Tesla boss Elon Musk on Bitcoin in 2021 critically changed the payment. This illustrates how news and the influential can, with great ease, weigh on cryptocurrencies and so make them more volatile.

Market Speculation

Cryptocurrency markets are largely speculation-driven. Many investors buy cryptocurrencies not for their utility or long-term value, but for quick returns. As a result of this tendency to speculate, price bubbles tend to form, with overhyped assets experiencing massive increases in valuation, only to crash almost as suddenly.

Dogecoin, a meme cryptocurrency, increased in value about 12,000% in early 2021 but dropped months later, for instance. This speculative action actually increases the volatility of cryptocurrency prices significantly.

Limited Market Liquidity

Liquidity describes the ability to purchase or liquidate an asset without impacting its value. Overall, liquidity in cryptocurrencies is lower than in traditional financial markets. Fewer market players mean even small trades can make a big difference in prices — especially for smaller cryptocurrencies.

Nascent Market Stage

Now compared to stocks, bonds, or forex, cryptocurrencies are relatively new. Because it is still in this very young stage, the market is more easily moved and more volatile. Unlike traditional financial assets, cryptos don’t have historical track records and institutional investment to help mitigate volatility.

Examples of Technology Developments and Security Concerns

The technology that drives cryptocurrencies — blockchain — is continuously changing. A successful upgrade or security breach can have a shock effect. A price decline, for instance, could result from a hacker attack on a major crypto exchange that undermines investor confidence.

Psychological Factors

For example, investor sentiment like fear of missing out (FOMO) or panic selling has a huge impact on cryptocurrency markets. That leaves emotional decision-making, which can amplify price swings as traders rush to buy or sell based on short-term market momentum rather than long-term drivers.

How to Calculate Cryptocurrency Price Volatility

Volatility is one part of the story, but measuring it can unlock actionable insights for just about any investor or enthusiast. Below are several popular methods to assess crypto volatility:

Volatility Index (VIX)

Although typically deployed across more traditional stock markets, crypto-specific volatility indices have begun to surface. These indices represent the anticipated volatility of the market, providing a sense of how much the market swings can be expected.

Bollinger Bands

Indicators of technical analysis like Bollinger Bands show when an asset’s price is moving beyond its historical norms. Bollinger bands widen with increased volatility and contract with stability.

Historical Volatility (HV)

HV is a measurement of the difference to the price of an asset over a certain period. This means they are likely to have a large price swing within this period.

Average True Range (ATR)

The ATR takes price volatility into account by looking at an asset’s daily highs and lows over a given period to provide a more granular view of recent market movements.

This combination allows investors to more accurately predict price fluctuations and modify their strategies accordingly.

Volatility Risk Management in Cryptocurrency

The price of cryptocurrency is exceptionally volatile, which can mean massively high yields, but has its inherent dangers. And here are some ways to manage and mitigate those risks:

Diversify Your Portfolio

Diversifying your crypto investments by holding multiple cryptocurrencies or combining them with traditional assets can mitigate risk. For instance, linking Bitcoin with mainstream altcoins such as Ethereum or Solana results in an even more diversified portfolio.

Only Invest What You Can Afford To Lose

Considering how volatile cryptocurrency markets are, never invest an amount you cannot afford to lose. So even if there was a big downturn, your financial stability as a company would not be affected even at all.

Dollar-Cost Averaging (DCA)

This strategy allows you to buy a specific amount of cryptocurrency at regular intervals, minimizing the impact of market changes. DCA focuses on consistency rather than speculation — avoid timing the market.

Set Stop-Loss Orders

All cryptocurrency exchanges give you the option to place stop-loss orders. This triggers the automatic selling of your cryptocurrencies when their price reaches a specific level, preventing further losses.

Stay Updated on Market News

Keep an eye on what’s happening in cryptocurrency, including regulatory news, technical developments, and big transactions. Knowing what’s going on allows them to anticipate what will trigger volatility.

Focus on Long-Term Goals

Guessing daily or weekly crypto prices causes panic and gives us impulse control issues. Avoid looking too closely at short-term values; take profits where you can, guard against panic selling, and instead focus on the long-term gains for cryptocurrency, especially established coins like Bitcoin and Ethereum.

The Importance of Volatility for Investors

Understanding crypto asset price fluctuations isn’t only about surviving tumultuous market conditions — it’s about seizing the chance. Oil, for example, can create lucrative entry or exit points for traders during periods of great volatility. On top of that, understanding volatility deepens your understanding of the crypto space, making you a more confident and well-informed participant.

Cryptocurrencies are the cutting edge of financial innovation, and every frontier comes with risk. But knowing what drives price fluctuations and applying strong risk management strategies can help keep you profitable in the volatile world of cryptocurrency.

Conclusion: Surviving Crypto Volatility

The volatility of the cryptocurrency market may seem intimidating, but it is also what makes this market so interesting. You can master volatility rather than be challenged by it, knowing what price changes are underway, how to measure them, and how to deal with risk.

If you want to get into the crypto market but don’t know where to start, then lead with analysis and education. Learn about each crypto you invest in, and watch trends closely. The right approach means you can create a crypto strategy that works for you.

Negate hurdles to turn volatility into opportunity as you discover limitless opportunity in crypto.