News headlines are still focused on Bitcoin, the first and, so far, most successful cryptocurrency. But one thing that confuses and polarizes US investors is how volatile Bitcoin’s price is. This price volatility is an unprecedented opportunity; for others, it is an untenable risk. But what drives Bitcoin’s sharp price fluctuations, and why should investors in America watch closely? This blog will discuss Bitcoin price volatility, its influencing factors, and its implications for US investors.

By the end, you’ll appreciate better what causes the value of Bitcoin to go up or down — and more importantly, how that volatility might affect your investment strategy.

What is Bitcoin Price Volatility?

Price volatility refers to the measure of how much the price of an asset fluctuates over a specific period. For Bitcoin, this volatility is stark compared to traditional investment options like bonds or even stocks. Bitcoin’s price can witness double-digit percentage changes in just a single day—a phenomenon relatively rare in conventional financial markets.

For some context:

- In December 2017, Bitcoin hit an all-time high of nearly $20,000, only to drop below $7,000 within two months.

- In 2021, Bitcoin recently saw dips of over 30% within days, followed by sharp recoveries.

Such stark price movements are unfamiliar with more traditional investments, so Bitcoin’s volatility is often labelled as a strength and a weakness, depending on the investor.

Why US Investors Should Care

So, for US investors, understanding Bitcoin’s volatility isn’t just about understanding its risk—it’s about incorporating this steep fluctuation into your strategy and hoping to profit from it when possible. As Bitcoin is becoming increasingly treated as a “digital gold” or an inflation hedge, it is important to know the risks and returns of this asset class if you are considering investing in it.

What Drives Bitcoin Price Volatility?

To assess whether Bitcoin is right for you, it’s essential to understand the factors behind its wild price swings. Below, we examine some of the most significant reasons.

Limited Supply and Fixed Issuance

Bitcoin’s total supply is capped at 21 million coins, making it a deflationary asset. This built-in scarcity naturally affects its demand and, correspondingly, its price volatility. Imagine an asset with a finite quantity combined with unpredictable demand—a perfect recipe for price swings.

For example:

- When new investors or institutions decide to buy Bitcoin in bulk, demand surges, often causing abrupt price spikes.

- On the flip side, when Bitcoin holders offload their assets en masse, the supply increases, causing prices to drop.

Market Size and Liquidity

The cryptocurrency market is relatively small compared to more significant financial markets like the NYSE or NASDAQ. This means Bitcoin is more vulnerable to large trades and external shocks.

- Low Liquidity: Bitcoin markets lack the liquidity of traditional markets. A significant single transaction can result in outsized price changes.

- Market Sentiment: Even rumours or tweets from influential individuals, such as Elon Musk, have been enough to cause noticeable price disruptions.

Regulatory News

Bitcoin’s decentralized nature creates ambiguity regarding its legal and regulatory status—US-based announcements—whether restrictive policies or favourable rulings—frequently impact Bitcoin’s price.

Example:

- The approval of the first Bitcoin futures ETF in the United States in October 2021 triggered a surge in interest, pushing Bitcoin prices to one of their highest levels that year.

- Conversely, repeated crackdowns or unfavourable comments from regulators cause sharp declines as investors grow wary.

Influence of Media and Public Sentiment

Bitcoin’s price rallies and slumps are often linked to media coverage and public perception. Bullish news stories lead to price spikes, while bearish sentiments cause sell-offs.

For instance:

- Joyous news, such as adoption by major companies or countries (e.g., El Salvador), can encourage more investors and increase prices.

- Negative coverage, such as security breaches or accusations of environmental harm, can dampen sentiment and result in sudden sell-offs.

Speculative Trading

Much of Bitcoin is speculation, with purchases made more to profit from short-term price action than long-term value. These speculators frequently use leverage, magnifying profits and losses and generating significant, destabilizing moves in the marketplace.

Implications of Bitcoin Volatility for US Investors

Bitcoin’s price swings could be seen as a blessing or a curse, depending on how you invest. Below some things for US investors to consider:

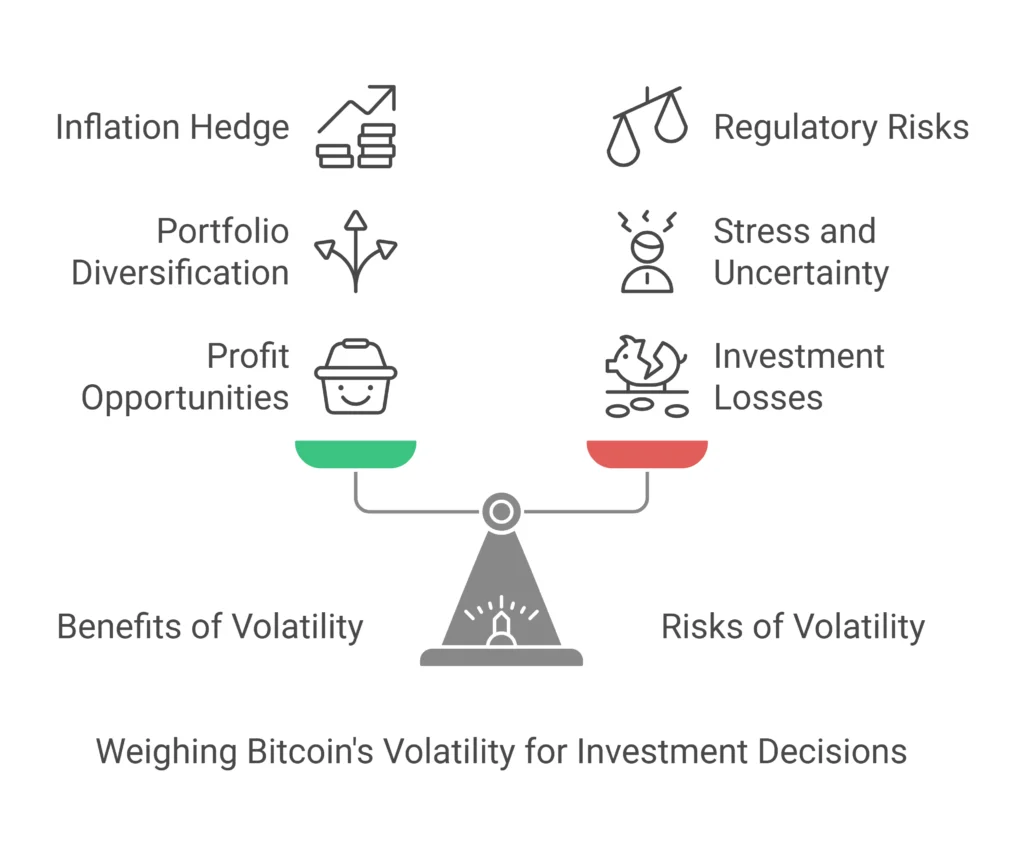

Benefits of Volatility

- Profit Opportunities: For risk-tolerant investors, Bitcoin’s price swings create opportunities to buy low and sell high.

- Portfolio Diversification: Bitcoin’s behaviour often differs from traditional asset classes like stocks and bonds, making it a potential hedge against other market downturns.

- Inflation Hedge: Given its limited supply, Bitcoin is often compared to gold to protect against inflationary pressures.

Risks of Volatility

- Investment Losses: The same volatility that creates opportunities can also lead to significant losses, especially for those who don’t time the market correctly.

- Stress and Uncertainty: The emotional strain of watching such drastic price movements isn’t for everyone.

- Regulatory Risks: Ongoing regulatory uncertainty in the US also adds to Bitcoin’s overall investment risk.

How to Navigate Bitcoin Volatility

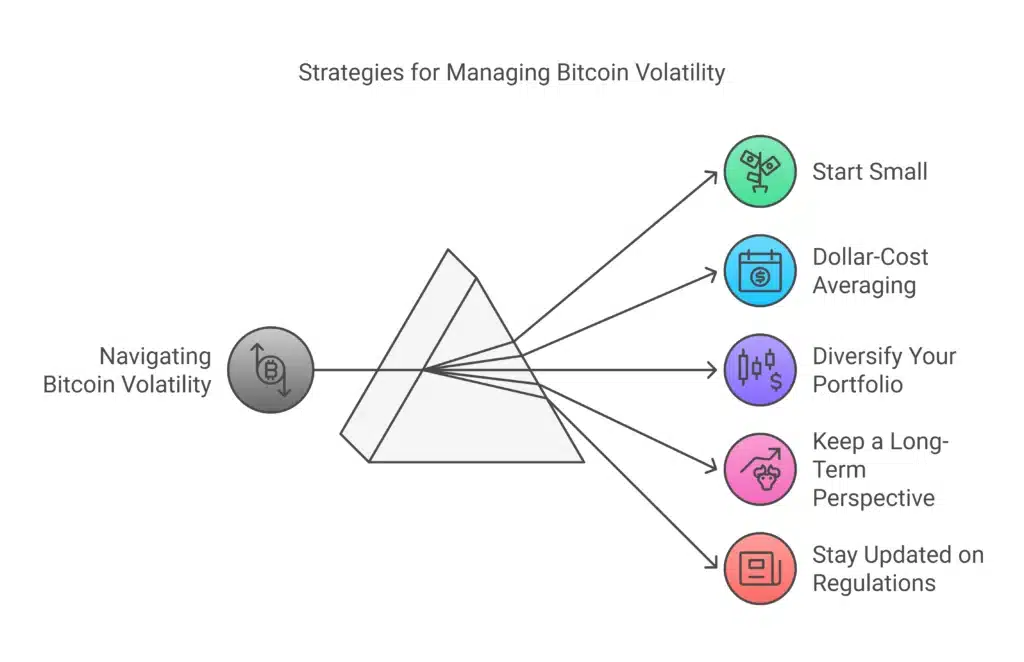

If you’re a US investor interested in Bitcoin, you need a strategy to manage its volatile nature. Here are some actionable tips:

Start Small

Start by dedicating a small portion of your portfolio to Bitcoin to get accustomed to its price fluctuations while minimizing overall financial risk.

Dollar-cost averaging (DCA)

Instead of trying to time the market, adopt a dollar-cost averaging strategy. This involves investing a fixed amount regularly, regardless of price. Over time, this approach reduces the effect of volatility.

Diversify Your Portfolio

Bitcoin should only represent part of your investment strategy. Balancing it with stocks, bonds, and other asset classes provides stability to your portfolio.

Keep a Long-Term Perspective

Rather than focusing on short-term price movements, consider Bitcoin’s long-term potential and historical growth trajectory.

Stay Updated on Regulations

Staying informed about regulatory developments in the US can help you prepare and react to market shifts driven by government decisions.

Why Bitcoin Volatility Matters More Than Ever

The volatility of Bitcoin’s price is both a lure and a repulse for US investors. It is daunting, but it also reflects the potential for huge payoffs. With strategic planning, a sound approach, and knowledge of the trends that fuel this volatility, investors can convert Bitcoin’s relativistic behaviour into an advantage.

With Bitcoin entering the mainstream and tools available to reduce risk, now is a critical time for US investors to take a serious look at this transformative asset class. So whether your curiosity leads you to budget a small test or the entirety of your Q4 for an initial exploration of creative possibilities, what you learn today can help set you up for long-term success.