Whether you’re new to cryptocurrency investing or you’ve spent hours researching blockchain technology, chances are you’ve come across the term “altcoins.” But what exactly are altcoins, and how do they differ from the world’s most well-known cryptocurrency, Bitcoin? This guide will break down the concept of altcoins, explore their key distinctions compared to Bitcoin, and equip you with the knowledge to make informed decisions about cryptocurrency investments.

What Are Altcoins?

Altcoins, short for “alternative coins,” refer to all cryptocurrencies other than Bitcoin. While Bitcoin set the stage as the first decentralized digital currency in 2009, altcoins emerged to address perceived limitations of Bitcoin or introduce new features and use cases. Today, thousands of altcoins exist, ranging from well-known options like Ethereum and Litecoin to obscure cryptocurrencies catering to niche markets.

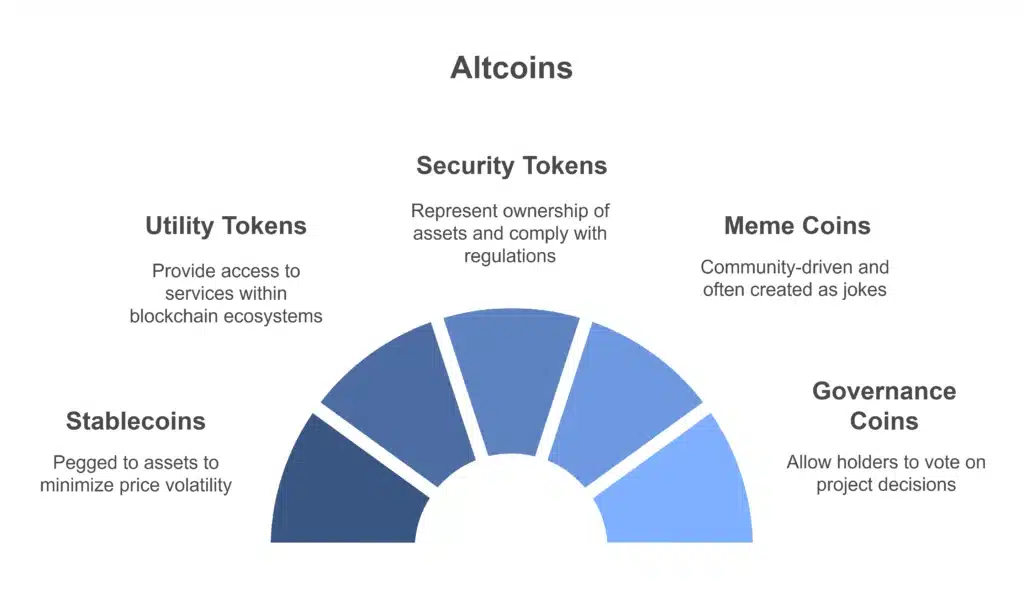

Types of Altcoins

Altcoins are not a single category; they come in various forms, catering to different needs and industries. Here are the primary categories:

Stablecoins

Stablecoins are designed to reduce price volatility by pegging their value to assets like fiat currencies (e.g., US dollars) or commodities (e.g., gold). Examples include Tether (USDT) and USD Coin (USDC).

Utility Tokens

These altcoins provide access to a product or service within a particular blockchain ecosystem. For instance, a Basic Attention Token (BAT) can be used within the Brave browser ecosystem to reward creators.

Security Tokens

Security tokens represent ownership of an asset, such as company equity or real estate, and are subject to federal securities regulations.

Meme Coins

Often created as jokes or community-driven projects, meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) gained popularity due to their viral nature.

Governance Coins

These allow holders to vote on project decisions within a blockchain network. For example, Uniswap (UNI) enables token holders to influence the development of the Uniswap protocol.

Privacy Coins

Privacy-focused cryptocurrencies like Monero (XMR) and Zcash (ZEC) aim to make transactions anonymous and untraceable.

With so many altcoins available, it’s essential to research their purpose, technology, and utility before investing.

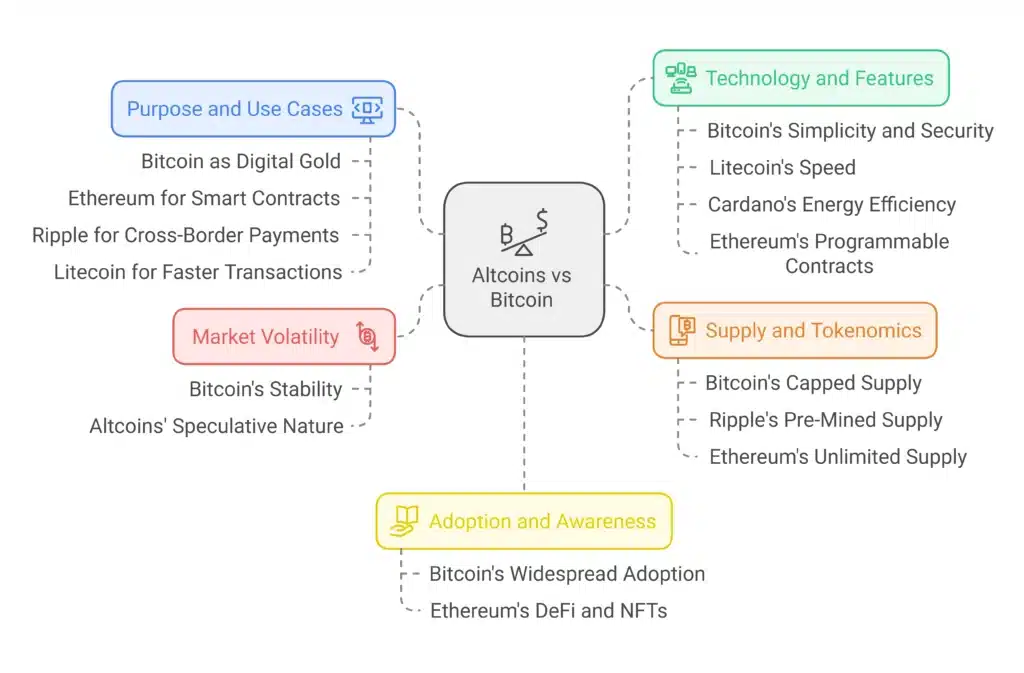

How Do Altcoins Compare to Bitcoin?

Altcoins and Bitcoin share similarities in that they are both blockchain-based cryptocurrencies. However, their purpose, functionality, and adoption differences are key to understanding their roles within the crypto ecosystem. Below, we highlight some of the significant differences between altcoins and Bitcoin.

Purpose and Use Cases

Bitcoin was initially designed as a decentralized digital currency for peer-to-peer transactions, often called “digital gold.” Its primary use cases are a store of value and a medium of exchange.

Altcoins, on the other hand, often target specific use cases or problems. For example:

- Ethereum enables smart contracts and decentralized applications (dApps).

- Ripple (XRP) focuses on fast and low-cost cross-border payments.

- Chainlink (LINK) connects smart contracts to off-chain data.

These varying purposes make altcoins more diverse in functionality and more specialized than Bitcoin.

Technology and Features

Bitcoin’s blockchain is known for its simplicity, security, and reliability. It employs a proof-of-work (PoW) consensus mechanism to validate transactions, which can be energy-intensive.

Many altcoins, however, introduce innovative technologies and features:

- Faster Transaction Speeds: Litecoin processes transactions faster than Bitcoin.

- Energy Efficiency: Some altcoins, like Cardano, use proof-of-stake (PoS) mechanisms to reduce energy consumption.

- Smart Contracts: Ethereum was the first blockchain to enable programmable contracts, opening the door to decentralized applications.

Altcoins continue to push the limits of blockchain technology, offering advancements that complement Bitcoin’s foundational strengths.

Market Volatility

Cryptocurrencies are known for their price volatility, and altcoins are no exception. However, Bitcoin tends to be more stable than smaller altcoins due to its widespread adoption and higher market cap. For instance, Bitcoin’s dominance in the market allows it to set the tone for the crypto market as a whole, while altcoins are generally more susceptible to speculative trading.

Adoption and Awareness

Bitcoin remains the most recognized and established cryptocurrency. Many businesses and institutions that adopt cryptocurrency start with Bitcoin because of its reputation and security.

Altcoins are catching up, especially those with strong use cases and active development teams. Ethereum, for example, has seen widespread adoption due to its versatility in supporting decentralized finance (DeFi) and NFTs.

Supply and Tokenomics

Bitcoin has a capped supply of 21 million coins, contributing to its scarcity and value as “digital gold.” Altcoins, however, may have different tokenomics:

- Ripple (XRP) pre-mines its entire supply.

- Ethereum has no hard cap, allowing its supply to grow over time.

Understanding the tokenomics of an altcoin is crucial for gauging its long-term value proposition.

Should You Invest in Altcoins or Bitcoin?

Your choice between investing in Bitcoin, altcoins, or both depends on your goals, risk tolerance, and understanding of the market. Here are a few considerations to guide your decision:

- Diversification: If you’re risk-averse, consider starting with Bitcoin due to its stability and market dominance. Gradually diversify into established altcoins with proven use cases like Ethereum or Binance Coin (BNB).

- Research: Thorough research is critical when investing in Bitcoin or altcoins. Look into a coin’s technology, adoption, market cap, development Team, and overall credibility.

- Stay Updated: Cryptocurrency markets change rapidly. Monitoring news, trends, and regulatory developments can help you make informed decisions.

- Start Small: For beginners, it’s wise to start with a small investment and gradually increase your stake as you gain confidence and knowledge about the crypto market.

Common Misconceptions About Altcoins

Jumping into the world of altcoins comes with its fair share of myths and misconceptions. Here are three to avoid:

“Altcoins are just knockoff Bitcoins.”

While Bitcoin was the first cryptocurrency, many altcoins were designed to solve different problems. Comparing them purely as competitors ignores the diversity in use cases.

“Altcoins won’t last.”

While it’s true that some altcoins will not succeed, others, like Ethereum or Solana, have shown resilience and innovation, cementing their place in the market.

“Altcoins are only for tech-savvy investors.”

Today’s platforms make buying, selling, and researching altcoins easier. Whether you’re tech-savvy or new to cryptocurrency, intuitive tools are available to help you get started.

Exploring Altcoins as an Investor

Understanding the differences between altcoins and Bitcoin is essential for anyone exploring cryptocurrency investing. While Bitcoin remains the leader, altcoins present exciting opportunities with diverse use cases, innovative technologies, and the potential for high returns. However, they also come with more significant risks, so a well-balanced approach and thorough research are crucial.

If you’re ready to start your cryptocurrency investing journey, explore the top-performing altcoins alongside Bitcoin. Remember, the key to success in the crypto market lies in education, patience, and adaptability.