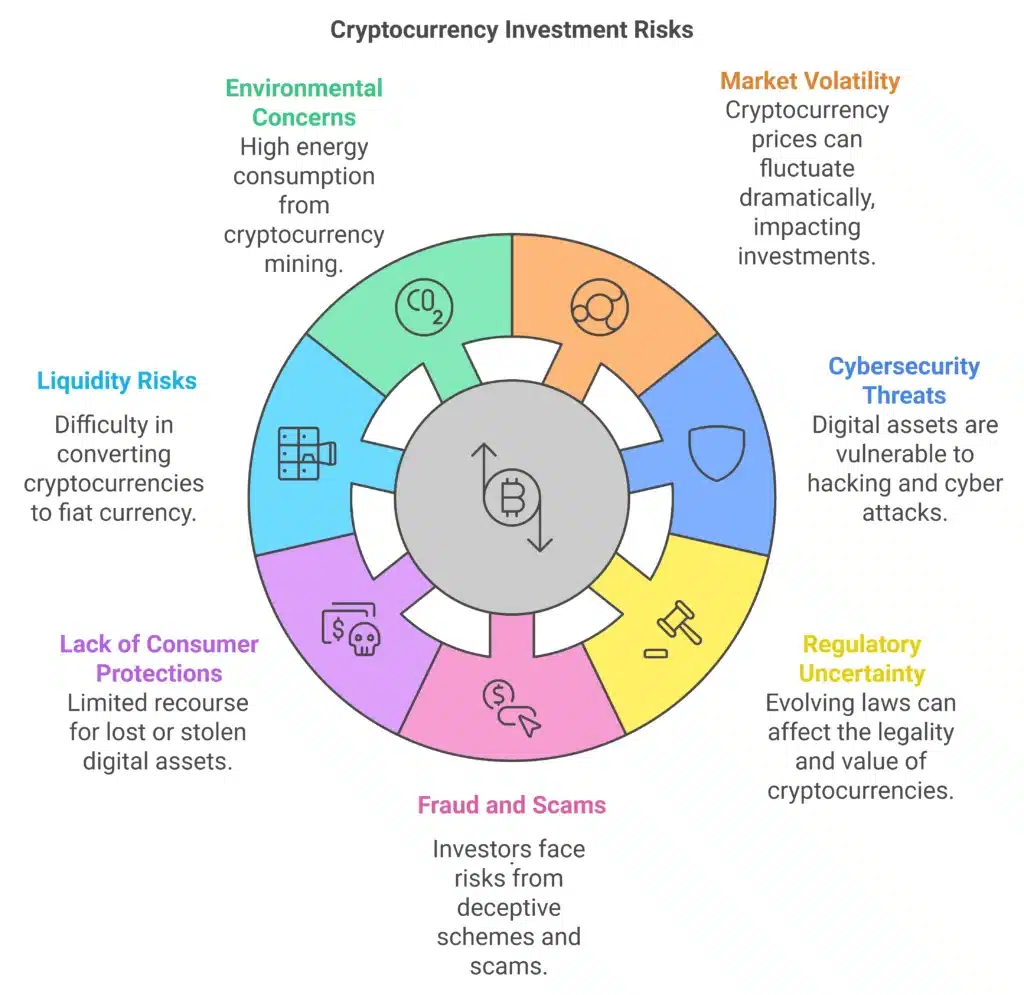

Introduction: What Are the Risks of Investing in Cryptocurrency?

Cryptocurrency investments have gained significant popularity in recent years. While they offer exciting growth opportunities, it’s essential to be aware of the risks associated with digital assets. This article will explore the key risks of investing in cryptocurrency, from market volatility to regulatory uncertainty. Understanding these risks is crucial for investing in this emerging market.

1. Market Volatility: The Rollercoaster of Cryptocurrency Prices

Understanding Cryptocurrency Market Volatility

One of the primary risks of cryptocurrency investments is the extreme market volatility. Unlike traditional stocks or bonds, digital assets such as Bitcoin and Ethereum can experience drastic price fluctuations within short periods. This volatility can be caused by various factors, including investor sentiment, global economic events, and news surrounding regulatory decisions.

How to Manage Volatility in Crypto Investments

Investors should be prepared for the crypto market’s unpredictable nature. Some strategies to manage volatility include setting stop-loss orders, diversifying investments, and focusing on long-term goals rather than short-term price movements.

2. Cybersecurity Threats: Protecting Your Crypto Assets

Security Risks in Cryptocurrency Investments

As digital assets, cryptocurrencies are vulnerable to cybersecurity threats. Hackers target exchanges, wallets, and personal accounts, leading to significant financial losses for investors. Phishing attacks, malware, and other types of cybercrime can compromise an investor’s holdings if they are not vigilant.

How to Protect Your Cryptocurrency from Hacks

Investors should prioritize strong encryption, use hardware wallets, and enable two-factor authentication on their accounts to safeguard investments. Regularly updating software and avoiding public Wi-Fi networks can also reduce the risk of cybersecurity threats.

3. Regulatory Uncertainty: The Evolving Legal Landscape of Crypto

Legal Risks in Cryptocurrency Investment

The regulatory environment for cryptocurrency is constantly evolving. While some countries have embraced crypto assets, others have imposed bans or strict regulations. The uncertain legal status of digital currencies in different regions poses a regulatory risk for investors.

How Regulatory Risks Impact Crypto Investments

Changes in government policy, such as new taxation laws or the introduction of stricter regulations, can negatively affect cryptocurrency prices and investment opportunities. Investors must stay informed about regulatory developments to avoid sudden legal changes that could impact their portfolios.

4. Fraud and Scams: Protecting Yourself from Deceptive Schemes

The Threat of Cryptocurrency Scams

Cryptocurrencies have become a target for fraudulent schemes, such as Ponzi schemes and fake Initial Coin Offerings (ICOs). Scammers often prey on inexperienced investors looking for quick profits in the crypto market.

How to Avoid Cryptocurrency Scams and Fraud

To protect against fraud, investors should conduct thorough research before investing in any cryptocurrency or platform. Avoiding offers that seem too good to be accurate and ensuring the legitimacy of projects through reliable sources are crucial steps in reducing fraud risk.

5. Lack of Consumer Protections: What Happens If You Lose Your Investment?

Absence of Consumer Protection in the Crypto Space

Unlike traditional financial systems, the crypto market lacks consumer protections. If you lose your cryptocurrency investment due to a hack, scam, or exchange failure, you usually have no recourse for recovering your funds.

What to Do if You Lose Your Crypto Investment

Understanding the lack of consumer protections is vital. Investors should only risk what they can afford to lose and consider using insurance services provided by specific platforms to mitigate potential losses.

6. Liquidity Risks: Difficulty in Converting Crypto to Fiat Money

Understanding Liquidity Risks in Cryptocurrency

Some cryptocurrencies may face liquidity risks, making them difficult to sell at the desired price or time. This is especially true for less popular altcoins or tokens. Liquidity issues can prevent investors from quickly accessing their funds when needed.

How to Overcome Liquidity Challenges in Crypto

Investors can reduce liquidity risks by focusing on more established cryptocurrencies with higher trading volumes, such as Bitcoin and Ethereum. They should also familiarize themselves with the exchanges that offer the best liquidity for their specific assets.

7. Environmental Concerns: The Impact of Mining on the Planet

The Environmental Cost of Cryptocurrency Mining

Cryptocurrency mining, particularly for Bitcoin, requires significant computational power, leading to high energy consumption. This environmental impact has raised concerns about the sustainability of specific cryptocurrencies, especially those that rely on energy-intensive proof-of-work mechanisms.

How to Invest Responsibly in Eco-Friendly Cryptocurrencies

Investors concerned about the environmental impact can consider cryptocurrencies that use proof-of-stake, less energy-intensive algorithms. Additionally, supporting projects focusing on sustainability and renewable energy for mining operations is another way to invest responsibly.

Conclusion: Weighing the Risks and Rewards of Cryptocurrency Investment

Investing in cryptocurrency can be exciting and rewarding but comes with its fair share of risks. Investors can make more informed decisions by understanding the potential dangers, including market volatility, cybersecurity threats, and regulatory concerns. Adopting strategies that minimize these risks and protecting your investments is essential. Cryptocurrency is a highly speculative market, so approach it with caution and a well-thought-out plan.